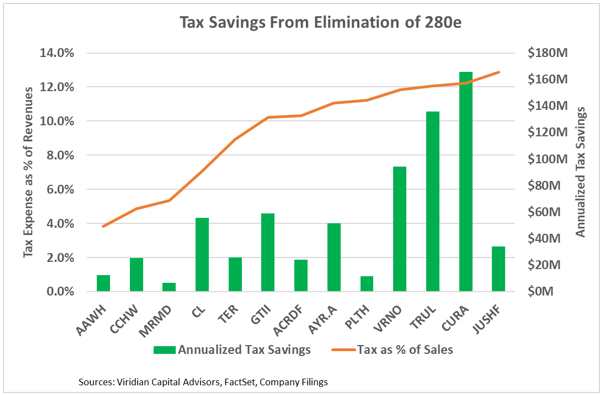

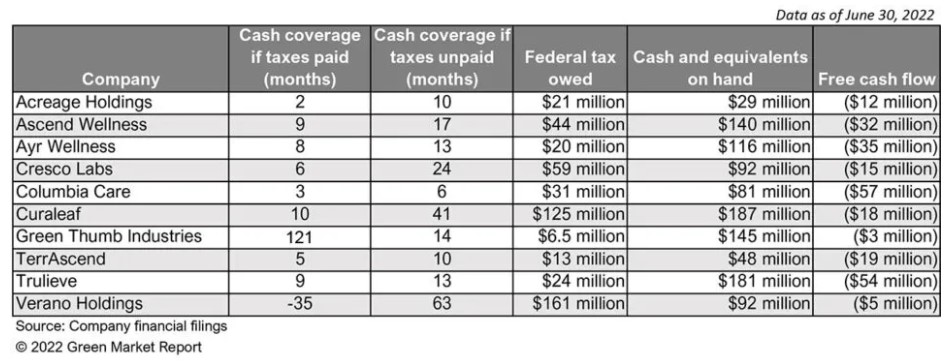

How Much Will MSOs Save in Taxes from Elimination of 280e?

One of the most important results of the potential rescheduling of cannabis to Schedule 3 is eliminating 280e taxes. In previous charts of the week, we have shown that 280e significantly negatively impacts cannabis companies by reducing their internally funded growth and limiting their debt capacity.

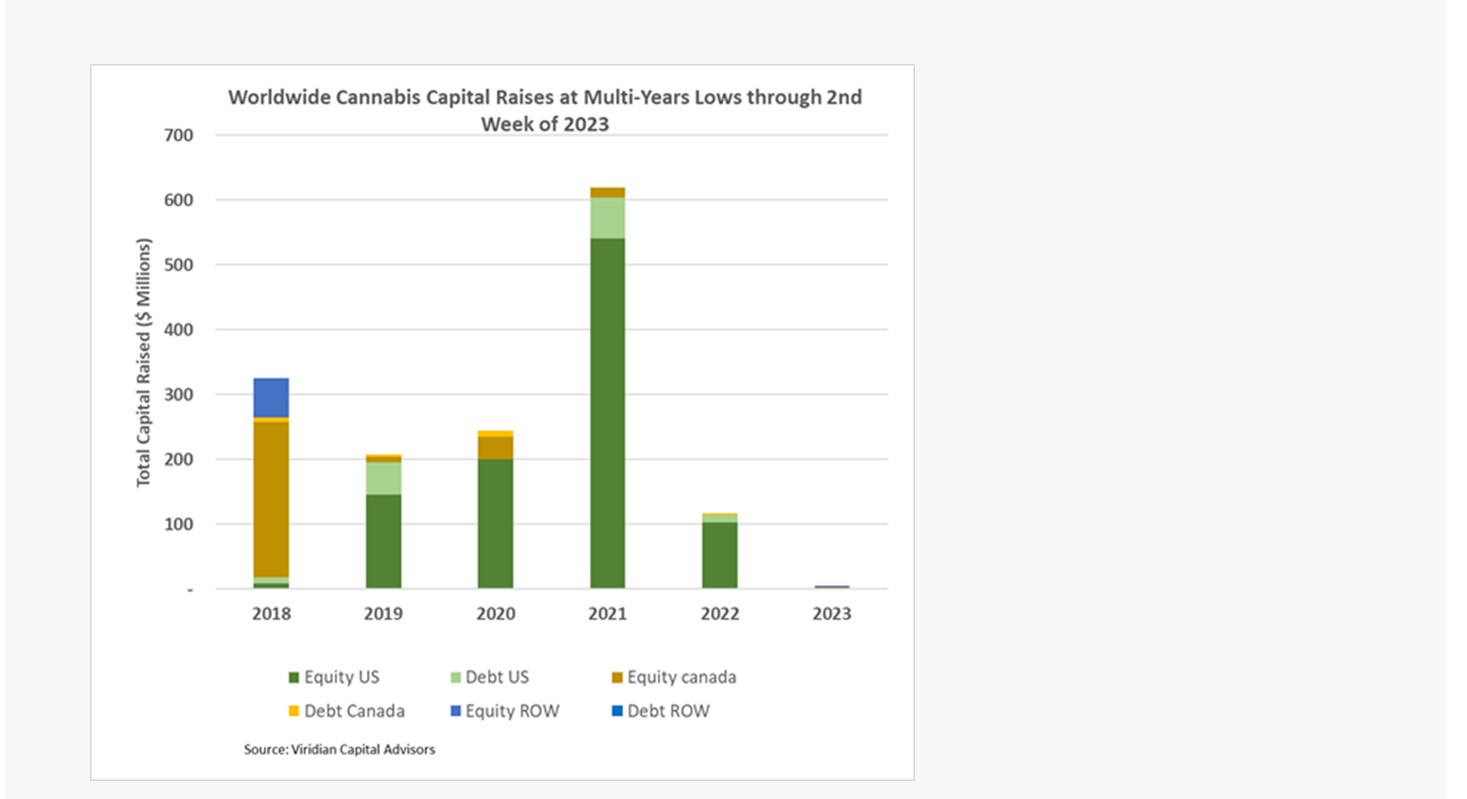

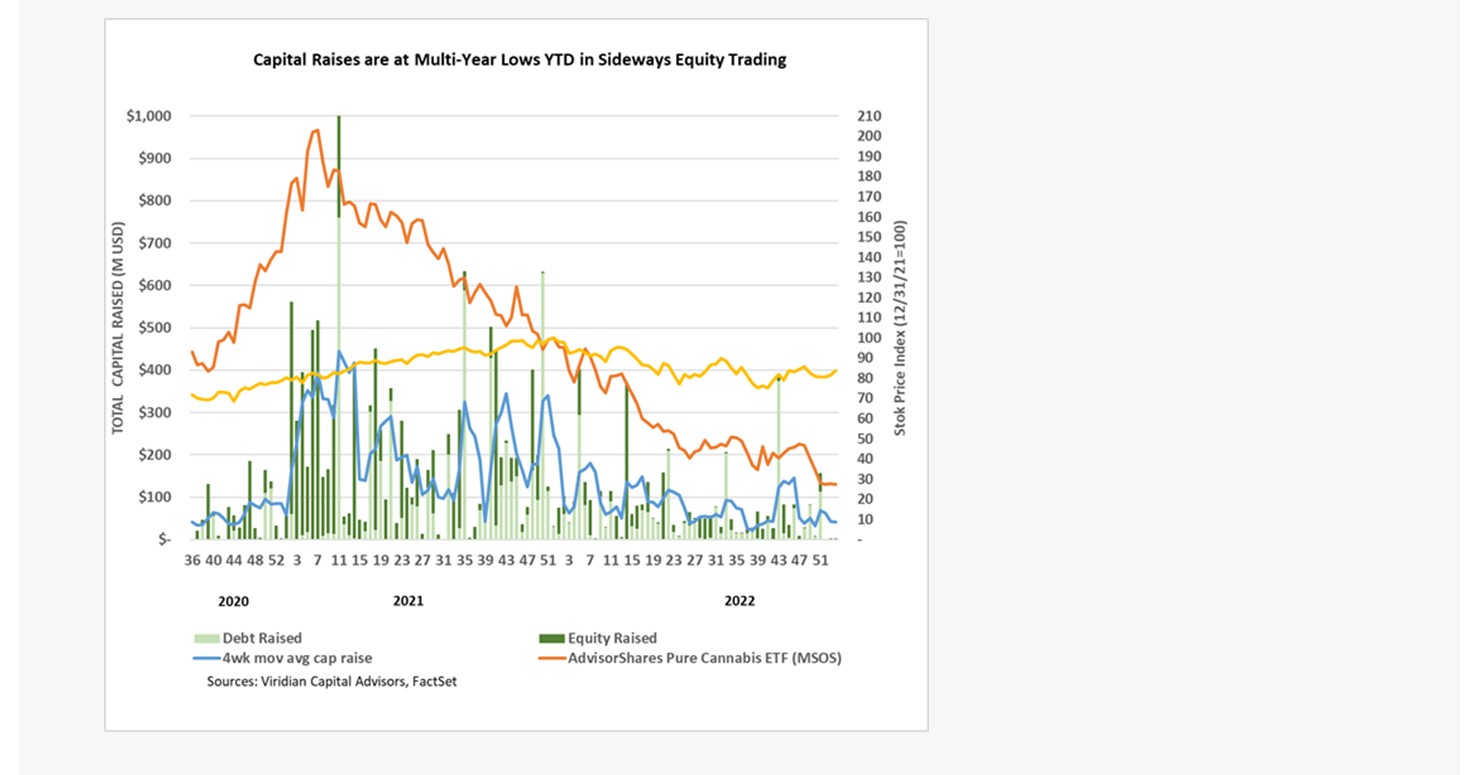

The chart explores the second-quarter tax rates of thirteen large MSOs and shows an estimate of the annualized tax savings for each company from the elimination of 280e.

We estimate that eliminating 280e would save the companies on the chart around $700M annually.

Over the last two years, a tight capital market and the cash-sapping impact of 280e have forced many cannabis companies to forgo acquisitions, reduce capital spending, and trim staffing. Savings from eliminating 280e will go far toward getting the industry back on a growth footing.

A top official at the U.S. Department of Health and Human Services (HHS) recommended in an Aug. 29 letter to the Drug Enforcement Administration (DEA) that cannabis should be reclassified as a Schedule III drug under the Controlled Substances Act (CSA).

This news, first reported by Bloomberg, has wide-ranging implications for the cannabis industry, including a shift in federal policy that would recognize cannabis as having medical value should the DEA take up the HHS on its recommendation.

"Following the data and science, HHS has expeditiously responded to President Biden’s directive to HHS Secretary [Xavier] Becerra and provided its scheduling recommendation for marijuana to the DEA on August 29, 2023," an HHS spokesperson said in a written statement sent to Cannabis Business Times. "This administrative process was completed in less than 11 months, reflecting this department’s collaboration and leadership to ensure that a comprehensive scientific evaluation be completed and shared expeditiously.

Should cannabis be reclassified as Schedule III it would break ties with “high abuse” substances like heroin, LSD, methaqualone and ecstasy, and instead join the likes of ketamine or acetaminophen products containing codeine. But the DEA has final authority over rescheduling drugs.

"We can confirm DEA received a letter from the Department of Health and Human Services providing its findings and recommendation on marijuana scheduling, pursuant to President Biden’s request for a review. As part of this process, HHS conducted a scientific and medical evaluation for consideration by DEA. DEA has the final authority to schedule or reschedule a drug under the Controlled Substances Act. DEA will now initiate its review," a DEA spokesperson said in a written statement sent to CBT. The spokesperson declined to confirm the Schedule III recommendation.

Reclassifying cannabis under the CSA would ease certain tax burdens on state-licensed cannabis operators, including lifting the 280E tax code that prohibits cannabis companies from deducting everyday expenses related to running their businesses.

The HHS recommendation comes after President Joe Biden directed in October 2022 Secretary Becerra and Attorney General Merrick Garland to initiate an administrative process to review how cannabis is scheduled under federal law. Specifically, the HHS was tasked with overseeing a medical and scientific analysis of cannabis. The department coordinated this review with the U.S Food and Drug Administration (FDA), which considered eight factors before making a determination for the control status recommendation.

According to federal statute, these eight factors include:

- Its actual or relative potential for abuse;

- Scientific evidence of its pharmacological effect, if known;

- The state of current scientific knowledge regarding drug and other substances;

- Its history of current pattern of abuse;

- The scope, duration and significance of abuse;

- What, if any, risk there is to the public health;

- Its psychic or physiological dependence liability; and

- Whether the substance is an immediate precursor of a substance already controlled.

Now with the HHS recommendation, the DEA is responsible for coming up with a final decision, but there is no deadline for this process set by the Biden Administration.

"The process already exists and has been undertaken countless times for other substances," said Shane Pennington, partner at Porter Wright Morris & Arthur LLP and well-known cannabis policy advocate and expert. "[There is] no deadline for DEA to act, that's true. Historically, the whole process has taken an average of 9.2 years to complete, with HHS taking an average of 2.4 years to get their recommendation to DEA. We're moving fast, but we still have a ways to go."

Should the DEA follow through with the HHS recommendation and reclassify cannabis as Schedule III, trafficking it or an adulterated version of it, would remain a criminal penalty, according to Rezwan Khan, president of DNA Genetics and executive chair and president of trade association Global Alliance for Cannabis Commerce.

“Currently, there are FDA-approved drugs containing CBD and synthetic THC, so any product containing those molecules is an adulterated drug and could constitute criminal manufacture, distribution, etc., of a controlled substance,” he wrote in November 2022. “State adult-use markets would also be subject to FDA oversight and traditional pharmaceutical channels of distribution.”

Pennington said most people believe reclassifying cannabis to Schedule III would make cannabis an FDA-controlled drug, but that's one of the biggest myths circulating right now. "Cannabis already is an FDA-controlled drug. FDA has jurisdiction over cannabis today and will continue to regardless of what schedule (if any) it's on," he said. "The reason the industry doesn't worry about FDA right now is because the federal government isn't enforcing the [Federal Food, Drug, and Cosmetic Act] against cannabis companies and hasn't for some time (with the exception of a couple of warning letters to CBD companies who claim their products cure or treat various illnesses)."

The FDCA is "a set of United States (US) laws that authorize the Food and Drug Administration (FDA) to oversee and regulate the production, sale, and distribution of food, drugs, medical devices, and cosmetics," according to the National Institutes of Health.

"Bottom line," said Pennington, "Schedule I isn't protecting cannabis or cannabis companies from any federal enforcement or oversight. It's the most restrictive classification possible under federal law. Moving cannabis to schedule III would not add a single requirement to it federally. Not one."

Kris Krane, director of cannabis development for KCSA Strategic Communications, said in October when the call to review cannabis's schedule was first announced that the action the U.S. government takes is perhaps even more important than how cannabis is scheduled.

“A move to Schedule II or III could be really problematic. But that also all depends. It could be nothing,” Krane said in October. “So much depends on what the federal government does in terms of implementation and enforcement. It's fully federally illegal. Everything that every one of these companies is doing is a complete and total violation of federal law, and yet the federal government's just allowing it to continue on at the state level.”

Another common misperception about rescheduling cannabis is that a Schedule III classification under the CSA would break certain federal barriers to scientific research on the plant for universities and independent labs. "This is what 99.9% of people believe, and I totally understand why," said Pennington. "As a general rule, Schedule I imposes research restrictions that are far more severe than schedule III. It follows that transferring most substances from Schedule I to III would open up research on those substances. Unfortunately, cannabis is different. The research restrictions that apply to it do not turn on scheduling. They are specific to marijuana itself," he said. "Ironically (and tragically), the reason for this perverse reality is the marijuana research bill [the Medical Marijuana and Cannabidiol Research Expansion Act] that POTUS signed into law late last year. While putatively designed to enhance and promote cannabis research, it amended the CSA to impose special cannabis-specific research requirements. Because those new requirements do not hinge on cannabis's scheduling classification, they also won't go away if cannabis is rescheduled."

Despite some misconceptions and many unknowns, industry stakeholders expressed enthusiasm about the possibilities of this incremental reform, several calling it "historic."

In a public statement provided to Cannabis Business Times, Verano founder and CEO George Archos said, “It’s about damn time.”

“We at Verano are incredibly excited to hear the news that the Department of Health and Human Services is calling for the rescheduling of cannabis to schedule III,” he said. “For far too long, cannabis prohibition and its outdated status as a schedule I substance have unduly harmed countless individuals affected by the failed war on drugs. As one of the nation’s fastest-growing industries employing half a million people and contributing hundreds of millions of dollars to local communities, states and economies every year, Verano is energized by the opportunity to reach its full potential and provide additional economic and social impact across the U.S."

Krane called this a "historic announcement," as it marks "the first time that a government agency, the Department of Health and Human services no less, has recognized that cannabis has medicinal value and a lower potential for abuse," Krane told CBT in an email. "This was the result of a nearly yearlong investigation and marks one of, if not the, most comprehensive reviews ever conducted by the federal government on the issue.

"In the short term, this has no major impact on the cannabis industry because the DEA now still has to conduct its own review and decide whether to follow the HHS recommendation. But given that this was called for by the president himself, it seems highly probable that cannabis will be moved to Schedule III sometime in the next year, likely before the 2024 presidential election."

US Cannabis Council Executive Director Edward Conklin said he “enthusiastically welcomes” the news, too.

“We believe that rescheduling to Schedule III will mark the most significant federal cannabis reform in modern history,” he said. “President Biden is effectively declaring an end to Nixon's failed war on cannabis and placing the nation on a trajectory to end prohibition. Cannabis should have never been scheduled alongside heroin and placed at the center of our nation's destructive drug war. Thankfully that era is coming to a close and is being replaced by a modern and scientific approach to regulating this plant.”

Conklin added that state-licensed cannabis businesses of all shapes and sizes will benefit from this HHS recommended reform.

U.S. Rep. Earl Blumenauer (D-OR), founder and co-chair of the Congressional Cannabis Caucus and a longtime leader in national cannabis reform, Tuesday released the following, less enthusiastic statement, emailed to Cannabis Business Times, in response to the HHS recommendation: “This is a step in the right direction but it is not sufficient. I hope it is followed by more significant reforms. This is long overdue.”

Amber Littlejohn, of counsel at law firm Ice Miller and former executive director of Minority Cannabis Business Association, also had a more moderated reaction. "While ideally the news from the administration would be the end to federal cannabis prohibition, today’s news is still a big step in the right direction," she told CBT in an email. "Today's news is good for the cannabis industry."

When asked about some industry constituents' fears about a possible big-pharma takeover under a Schedule III classification (with Schedule III drugs requiring a prescription), Littlejohn commented, "There is no change to the status quo. The industry would still be in limbo. To substantiate the fears would require believing the administration would begin enforcing cannabis laws against state regulated businesses when two-thirds of democratic voters and the majority of Americans support legalization.

"The pharmaceutical industry has and always will have an advantage over the cannabis industry due to the priority given to pharmaceutical research. It would be incumbent upon the current cannabis industry to take advantage of the changes and additional resources to prioritize investment into research."

"Relief" is what Jarrod Loadholt, partner with Ice Miller’s Public Affairs Group, said he felt upon hearing the news about the Schedule III recommendation.

"I think there were indications that [Schedule] III or IV would be the most likely destination for any kind of administrative rescheduling. III or IV, not II, was key, and I think this is a strong recommendation," Loadholt told CBT. "This is a significant step toward legalizing and normalizing cannabis … The fact that they did this in August tells me there is some urgency in this White House."

Pennington was surprised by how quickly HHS acted. "What did surprise me is that it happened today," he said, referring to the HHS Secretary Becerra's comment earlier this year that it "would

be likely the end of the year before we get our recommendation to DEA," Pennington noted. "And even that was fast. That was like 50% faster than the historical average for them to get this kind of work done. And on something so controversial where there's so much that's already been said, and the agency really has to sift through a lot of stuff to be able to make a case for making a change like this that they know everybody's going to look at. So it just shows you what a high priority this is that they got this out so fast."

In addition to surprise, though, Pennington's other reaction is focused on the immensity of the news. "It goes without saying that this is the most significant development in cannabis law for sure in history at the federal level without question. It's one of the biggest events in the history of American drug law," he said. "It's hard to overstate what a big deal it is."

Pennington and Khan, who commented Wednesday on phone calls with CBT, both raised the issue of possible conflict with the Single Convention on Narcotic Drugs, 1961, an international treaty that "aims to combat drug abuse by coordinated international action," per the United Nations website. The treaty "classified cannabis as highly addictive and liable to abuse, and that any non-medical or non-scientific use of cannabis contravenes the Convention," according to the International Narcotics Control Board (INCB).

"DEA can overrule HHS's recommendation if it thinks the treaty compliance requires requires them to," Pennington said.

A March 9, 2023, press release from the INCB, titled "The International Narcotics Control Board expresses concern over the trend to legalize non-medical use of cannabis, which contravenes the 1961 Single Convention on Narcotic Drugs," brought the INCB's concerns to light just six months ago.

Pennington adds that judicial review could also pose a stumbling block, should the DEA accept HHS' recommendation. "For this historic victory to sustain and to be meaningful, it's going to have to survive judicial review and make its way through the courts."

And the treaty and the judicial review go hand in hand. "When DEA goes to write a proposed rule and a final rule, it will have no choice but to address the treaty. Because the treaty has always factored in to cannabis scheduling in the past, and the agency just can't ignore that, or it definitely will get dunked on on judicial reviews."

Khan noted, "The DEA has to decide, and they're gonna roll out their decision. Now, if they decide to reschedule to a III, for example, then they run into the problem of the international drug treaty of 1961. That really puts them at odds with with being able to deliver it, right? The DEA, for that reason, would be inclined to reschedule to a [Schedule] II to keep themselves in line with the international drug treaty, while at the same time taking the recommendation on rescheduling."

Khan isn't in favor of rescheduling, though, as he stated in his November 2022 Cannabis Business Times opinion piece. As he commented Wednesday on the call with CBT, "rescheduling equates to recriminalizing" cannabis, despite some potential benefits afforded through a possible Schedule III reclassification, such as the end to IRS tax code section 280E.

Pennington said, "I'm on the record being fully supportive of descheduling." But he also said that "descheduling would not be utopia. If you really want to take seriously sort of the argument about consequences and what would happen, you need to think about all of the ramifications that descheduling would have."

Plus, he believes incremental progress is progress, he said, "and I would just strongly advise people, while I believe they are well-intentioned, to think carefully before they criticize something that's, you know, historic progress for a movement that we've all been working on so hard for so long. ... I'm just so proud of everyone, and I hope we can come together and get this done. The truth is we're all trying to get to the same place."

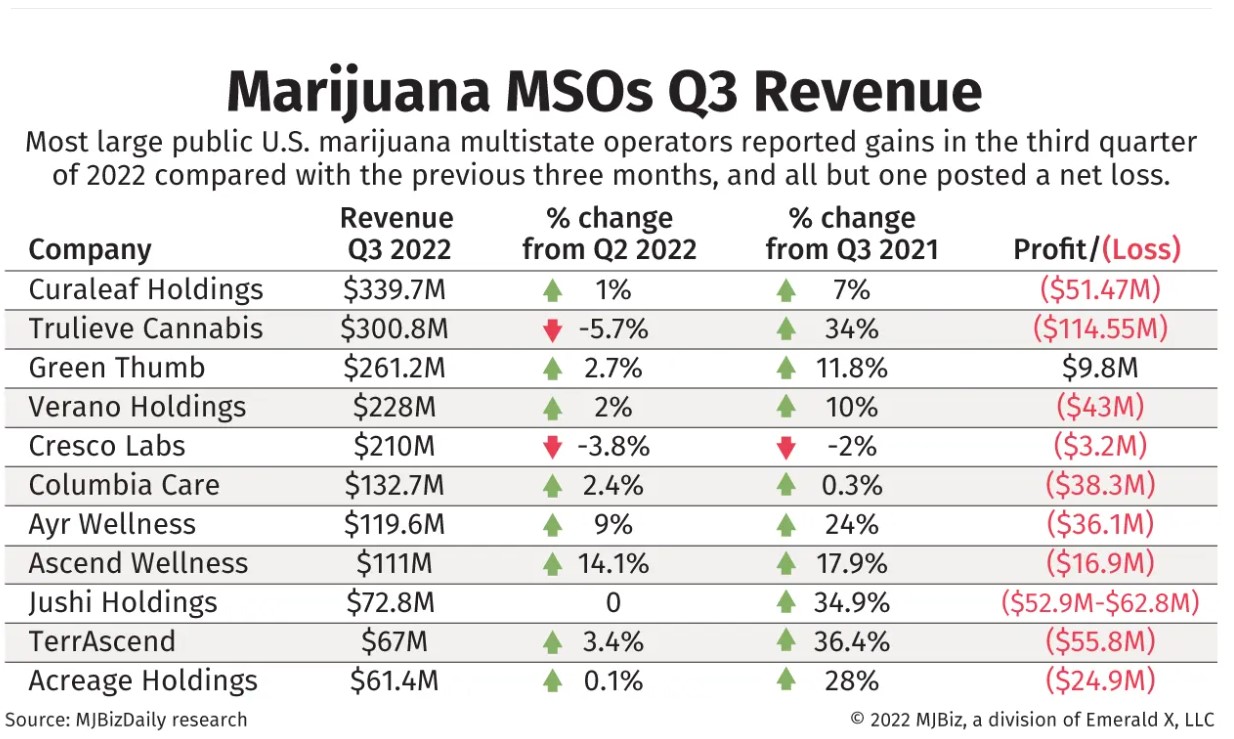

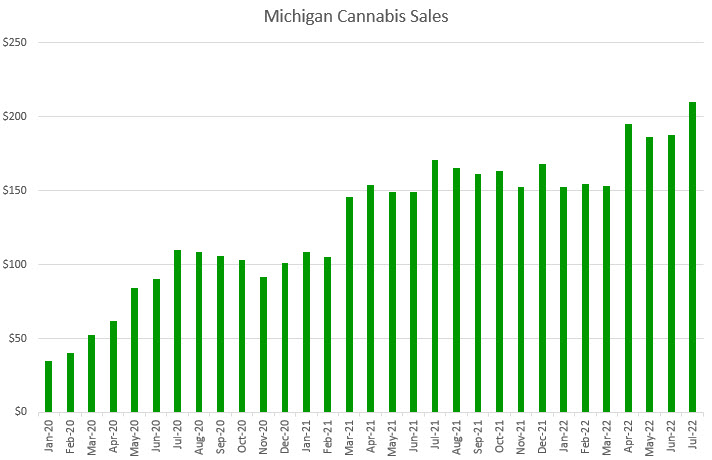

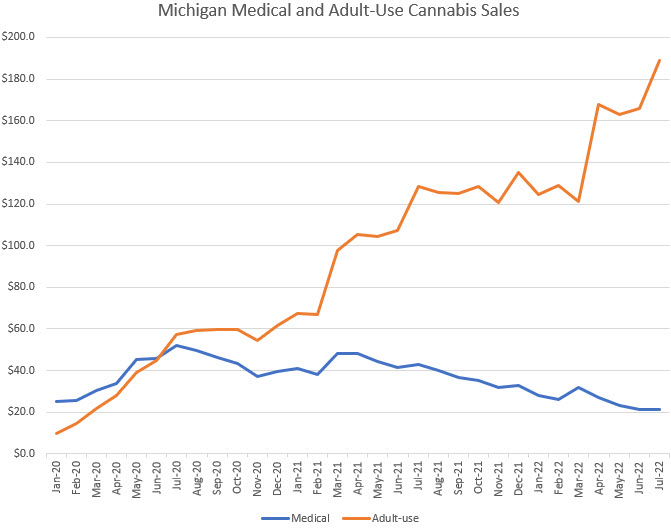

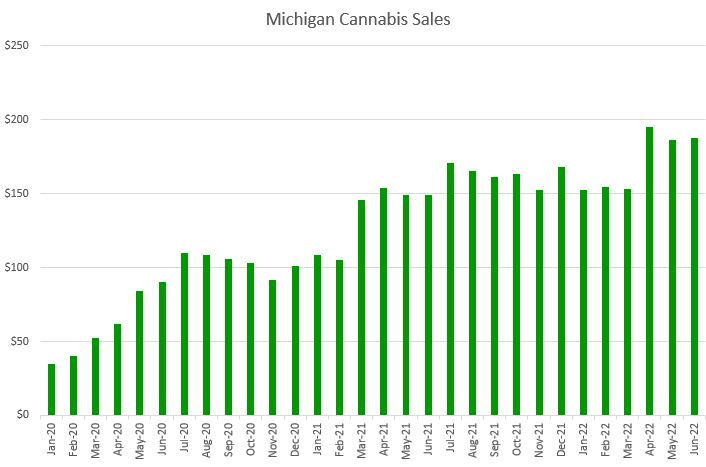

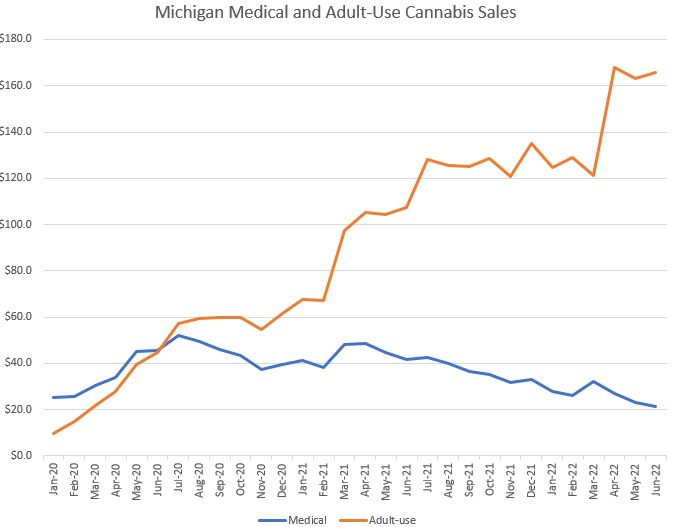

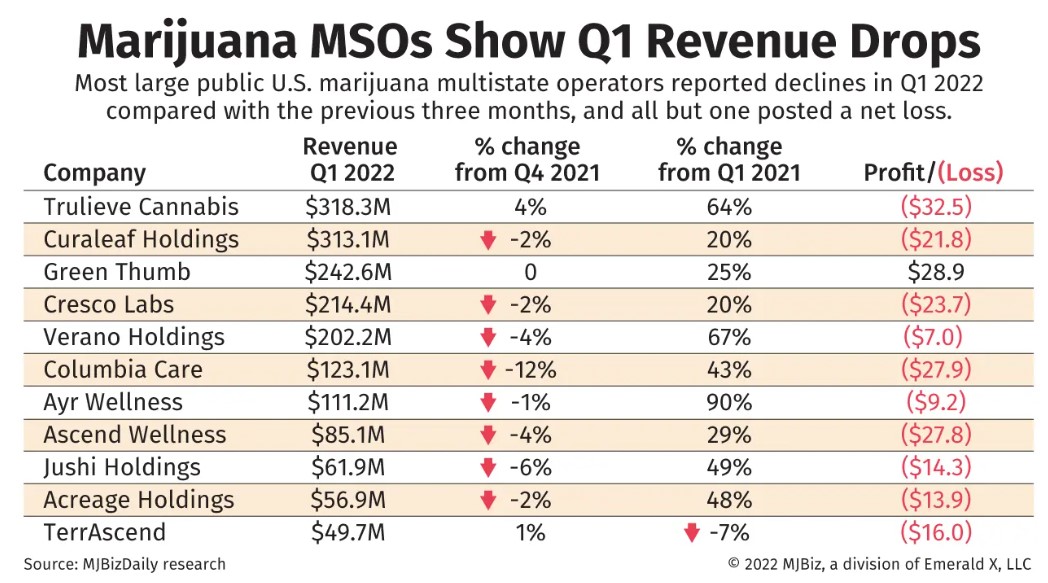

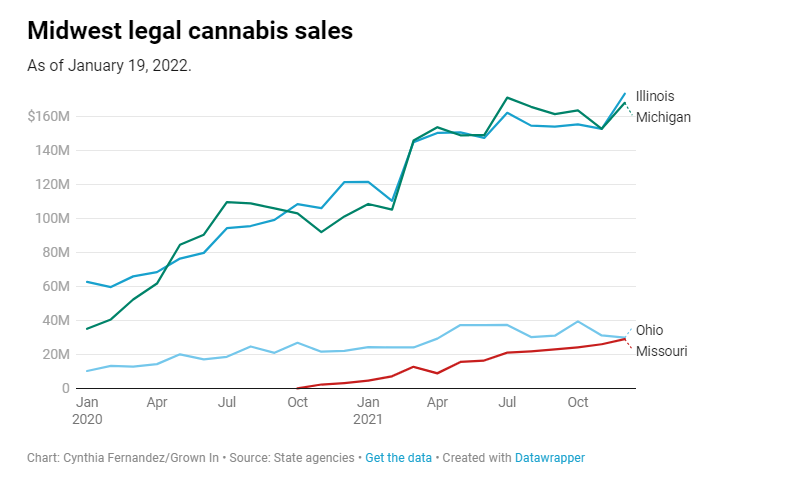

Despite the record sales, cannabis companies are struggling to turn a profit.

The Michigan marijuana market continued to break records in March, hitting a new sales high of almost $250 million for the month, after selling $2.3 billion in 2022.

The new sales record, first reported by New Cannabis Ventures, includes $9.8 million in medical marijuana sales and $239.8 million in recreational cannabis sales, for a total of $249.6 million in March, according to data from the Michigan Cannabis Regulatory Agency.

Sales were up by more than 15% from February, New Cannabis Ventures found, and up almost 63% from March 2022.

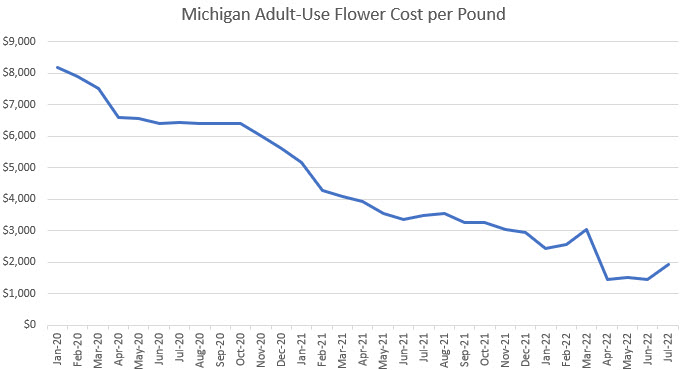

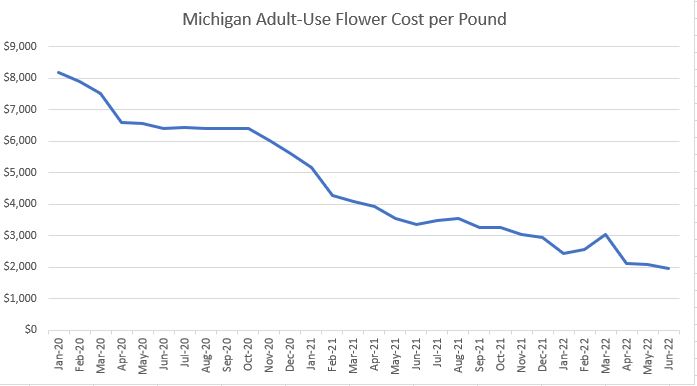

But the state report also confirmed that wholesale prices have been plummeting, with the average price per pound down more than 54% from a year prior.

With prices on the downslope, Michigan marijuana companies are struggling to turn a profit despite the record sales, Bridge Michigan reported. Retail prices per ounce of cannabis flower in February were down by almost half, to roughly $86 per ounce, from about $160 in February 2022.

According to the Cannabis Regulatory Agency report, Michigan in March had 1,999 active cannabis business licenses, including 656 retailers and 1,005 cultivators.

The number of growers, several sources told Bridge Michigan, is one of the reasons the market is currently oversupplied, which is largely what’s driving prices down.

“There’s way too much supply and so sellers are dropping their price so that they can get on the shelves of the retailers,” Beau Whitney, an economist with the National Cannabis Industry Association, told Bridge Michigan. That’s leaving very little room for profit, he said.

That’s likely to lead to consolidation in the near future, Whitney predicted.

“Those businesses that can’t get enough revenue … to cover their cost, they’re going to go out of business unfortunately,” he said.

“The big multistate operators and big corporations will buy distressed assets and consolidate the market,” Whitney said. “Instead of having hundreds of licenses, there will be substantially less than that.”

ASPEN, Colo.--(BUSINESS WIRE)--Toast, a leading multi-state pre-roll brand in the cannabis industry, is thrilled to announce its partnership with 42 Degrees Processing, a respected manufacturer and distributor in the Michigan market. With this partnership, Toast will launch a selection of their cannabis pre-rolls throughout Michigan.

Originating in Aspen, Colorado, Toast is a premium cannabis brand that has been crafting exceptional pre-rolls since 2017. Toast sets themselves apart in the market by their commitment to thoughtfully selected genetics, high-quality flower, impeccable craftsmanship, and beautifully designed packaging. This partnership with 42 Degrees Processing allows Toast to expand their reach and provide their innovative, superior quality cannabis products to Michigan-based consumers.

“We are excited to be partnering with 42 Degrees Processing,” said Punit Seth, Toast Co-Founder and CEO. “We selected 42 Degrees Processing due to their strong belief in the Toast vision, their exceptional manufacturing capability and their successful track record in launching multiple brands in Michigan. Brands produced by 42 Degrees Processing have distribution that span over 70% of the state providing Toast with the perfect launchpad for success.”

Michigan consumers, from the canna-curious to the “cannaseurs”, can discover the following products from Toast, with more expected to roll out in the future:

Toast Classic pre-rolls are precisely crafted 1g pre-rolls, which feature some of the most coveted and potent strains on the market. Toast Classics are available in Sativa, Indica and Hybrid varieties and are always mindfully made with 100% premium flower.

Toast Minis are perfectly dosed, impeccably rolled 0.35 gram versions of Toast’s Classic pre-roll. Minis are available in 10 packs of Sativa, Indica, or Hybrid—perfect for anytime and on-the-go.

Toast Infused pre-rolls are produced with a proprietary manufacturing process that ensures a smooth and perfect burn every time. Each extra special 1.2g pre-roll blends 100% flower with an expertly crafted, cannabinoid-forward concentrate. The Toast Infused pre-rolls are available in a Live Resin infusion, which features 42 Degrees Processing’s popular Fresh Coast Live Resin concentrate, as well as a Distillate + Terpenes infusion.

The Toast partnership marks 42 Degrees Processing’s first entry into flower or pre-rolled products. With Toast’s IP and SOPs and 42° strong manufacturing capability, 42 Degrees Processing has been able to quickly ascend the learning curve of pre-roll production.

“We are thrilled to be partnering with Toast,” added 42 Degrees Processing CEO Samuel Rosinski. “As a leading national pre-roll brand with established multi-state footprint, we knew they were the perfect partner for us to enter the flower and pre-roll category.”

Toast and 42 Degrees Processing are excited to begin this new chapter in their growth. Sharing similar core values that emphasize heritage, community, and craftsmanship, they look forward to working together to bring Toast to the Michigan market.

Michigan is Toast’s 4th active state, with several more state launches upcoming in 2023. Toast Classic and Toast Infused will be available in stores across Michigan. Michigan dispensaries interested in carrying Toast can contact misales@wetoast.com.

ABOUT 42 Degrees Processing

42 Degrees Processing is a brand foundry that helps clients forge ideas into finished goods for the Michigan market. Based in a 20k square foot facility in northern Michigan, 42 Degrees Processing works with over 300+ retailers across Michigan. Their dedicated and hardworking staff take a blue-collar approach to crafting tailor-made solutions for the brands they support. 42 Degrees Processing’s founders have operated in the Michigan marijuana market for a combined 35+ years; focusing on contract manufacturing, licensing and distribution of unique brands such as Fresh Coast and Toast. Learn more at www.42-deg.com.

ABOUT TOAST

Founded by ex-Bridgewater Associates alumnus Punit Seth, former Accenture Executive Shovahn Rincón and Former Global CMO of Anheuser Busch InBev Chris Burggraeve, Toast was born in 2017 in the heart of Aspen, Colorado. Toast’s signature cannabis pre-rolls elevates every moment with the perfect high, unmatched craftsmanship, and a touch of luxury.

An exhilarating blend of sin and soul, Toast is rooted in the spirit of the fresh Rocky Mountain air and infused with the cheeky indulgence of Aspen’s social scene. In that sweet spot, they have cultivated a premium cannabis experience unlike any other—one that honors the rich tradition and heritage of the plant.

Pairing heirloom strains with modern genetics, Toast works with local farms to hand-select only the most coveted flowers—bursting with aromatic terpenes and cultivated in mineral-rich soil—for a distinct terroir and a timeless euphoria with every perfectly dosed pre-roll.

Toast is founded on the belief that greater diversity makes for a more sophisticated finished product, a more beautiful celebration, and a greater world. Toast is focused on creating an inclusive and equitable environment within the cannabis industry and selects business partners who share its ethos. Celebrate Life in Full Spectrum.

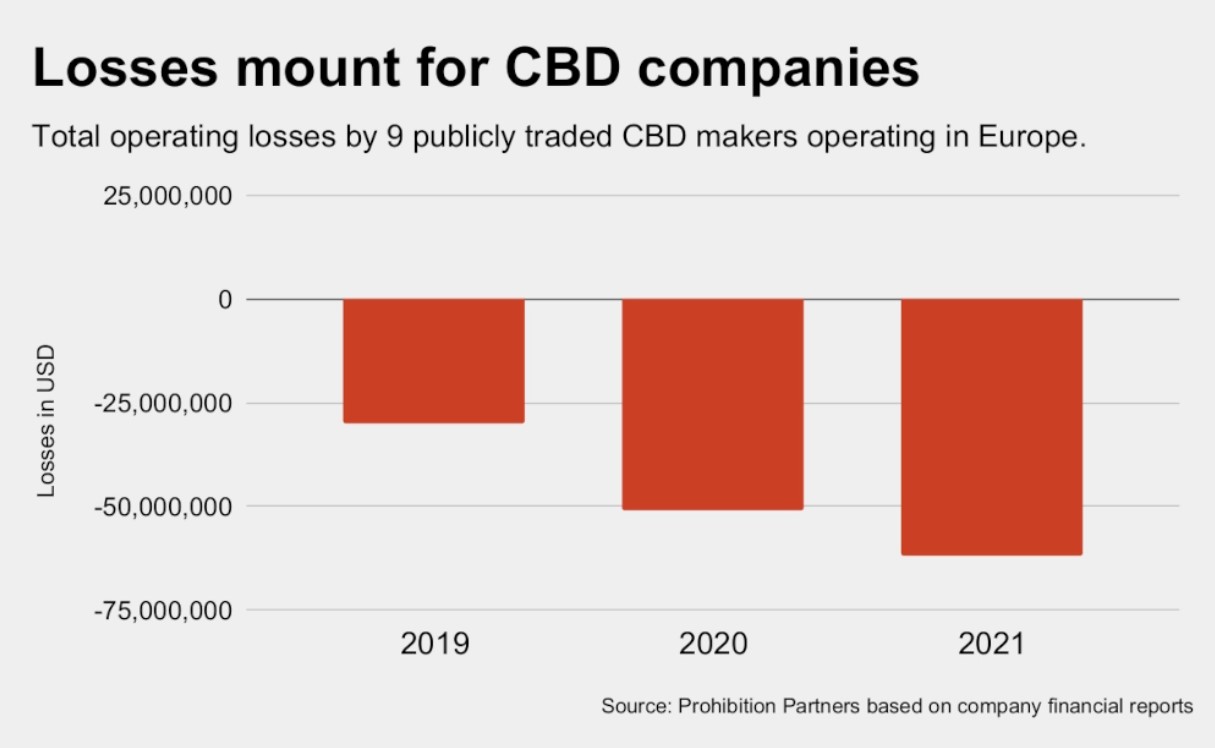

Companies analyzed included: CBD of Denver; HemPoland; Goodbody Health; Kanabo; Love Hemp; Chill Brands; Akanda; Futura Medical; Synbiotic; MGC Pharma; and Yooma Wellness.

A drastic imbalance between revenues and expenses shows publicly traded companies are overstretched in the European CBD market and continue to rack up massive losses, a UK cannabis analyst says in a recent report on the sector.

Eleven public companies researched by London-based Prohibition Partners had combined operating losses of €62 million for 2021. Six of those companies increased their operating losses by an average of 400%, while losses of three others averaged 65% that year, according to the report.

“Virtually no public company operating in the European CBD market is making an operating profit as of mid-2022. Indeed, as the number of operators increases and they each increase in size, the losses are mounting,” the report observes.

‘Early’ market

“This is attributable mostly to the early nature of the market, and the fact that most companies are still fighting for market share before regulations which properly support the industry are in place,” the report observes, calling the results of its study “troubling for those involved in the sector.”

“It should be noted that most companies are making less than €10 million in revenue per year, which speaks to the drastically fragmented market in European CBD,” the analyst said.

Stakeholders in Europe are pushing national authorities to set regulations for CBD after the European Commission ruled in 2020 that the compound is not a narcotic, can be qualified as food, and that CBD products should enjoy the same free movement of goods between and among member states as other legal products. But changes are coming slowly.

In the UK, CBD makers submitted nearly 12,000 CBD products to the Food Standards Agency’s process for approval of new or “novel foods.” That process has been troubled and also slow to develop, and the delays have contributed to some publicly traded companies being on the ropes.

Who will survive?

Meanwhile, amid the shortage of specific laws and regulations for CBD, the gray market continues to flourish across Europe and the UK, the report notes.

“CBD is now potentially the largest CPG (consumer) product in Europe which is, in the majority, sold under legally ‘grey’ conditions,” the authors write. “This situation is evolving fast, with new laws, regulations and enforcement practices changing at the European and national level on a quarterly basis.”

As those rulemaking and certification regimes develop, only producers which turn out high-quality products and are working their way down regulatory pathways, will survive, Prohibition Partners predicts in the report.

“Operators who are currently self-regulating to high standards or are participating in the novel foods applications will be the ones who will still be operating in five years,” the analyst writes.

Retail prices rebound

Retail prices for CBD products have returned to or surpassed 2019 prices after dipping roughly 25% in the intervening years, according to the report. That’s despite the fact that the cost of hemp flower biomass used to make CBD has plunged by as much as 75% since 2019, a reality the Prohibition Partners report gives short treatment. Some companies seeking to meet upcoming standards in Europe and the UK may be keeping prices high to recover costs associated with regulatory compliance, the report suggests.

In other observations, Prohibition Partners said:

- The vast majority of revenue in the CBD sector is being captured by private companies without any obligation to report to anyone.

- The CBD supply chain is likely to shift somewhat back towards European producers as the number of producers in the U.S. gradually declines and the EU’s Common Agriculture Policy continues to protect farmers from low-cost areas for cultivation.

- Fifty-one percent of current users surveyed said they expect to consume the same amount of CBD in the next 12 months as they did in the last 12 months.

- Large online marketplaces like eBay and Amazon are expected to offer full suites of products to European consumers.

California cannabis regulators seized more than 144,250 pounds of unlawful cannabis in 2022, which represents a 246% increase over the 41,726 pounds of cannabis seized by the agency the year prior. The Department of Cannabis Control (DCC) said arrests related to illegal cultivation tripled from 17 in 2021 to 56 last year.

In all, the cannabis seized by the agency last year was valued at $243,017,836. The DCC led 155 search warrant operations in 2022, which was a 150% increase from the 62 operations in 2021. The agency eradicated 264,196 cannabis plants – a 1,274% increase over 2021 levels (19,221 plants). In its operations, the DCC said it had seized 54 firearms last year – 14 more than 2021 – and seized nearly $1.3 million in cash.

Bill Jones, chief of DCC’s Law Enforcement Division, said the enforcement actions ensure “California maintains a well-regulated and legal marketplace that benefits Californians.”

The DCC also assisted on 144 cannabis enforcement operations last year. Those operations led to the seizure of nearly $494 million worth of illicit cannabis – including 295,546 pounds of processed product. The operations eradicated 696,016 plants, seized $542,981 in cash and 85 firearms, and led to 119 total arrests.

Adult-use cannabis sales in Michigan topped $1.8 billion during the 2022 fiscal year, according to the Michigan Department of Treasury. Municipalities that have opted into sales – 224 in all – will receive a share of $59.5 million from cannabis excise taxes collected on sales.

For the state’s 2022 fiscal year, each eligible municipality and county will receive more than $51,800 for every licensed retail store and microbusiness located within its jurisdiction, the Treasury Department said, noting that some municipalities host more than one licensed cannabis business.

Recipients of the tax revenues include 81 cities, 26 villages, 53 townships, and 64 counties.

In a statement, Cannabis Regulatory Agency (CRA) Executive Director Brian Hanna said that the funding that makes its way to local governments “is an important benefit of the regulated cannabis industry and the CRA is committed to doing our part in supporting our law-abiding licensees.”

In all, $198.4 million from excise taxes is available for distribution. In addition to the $59.5 million headed to municipalities and counties, $69.4 million was sent to the School Aid Fund for K-12 education, and $69.4 million was sent to the Michigan Transportation Fund, according to the Treasury Department.

The revenue was collected from 574 licenses throughout the state.

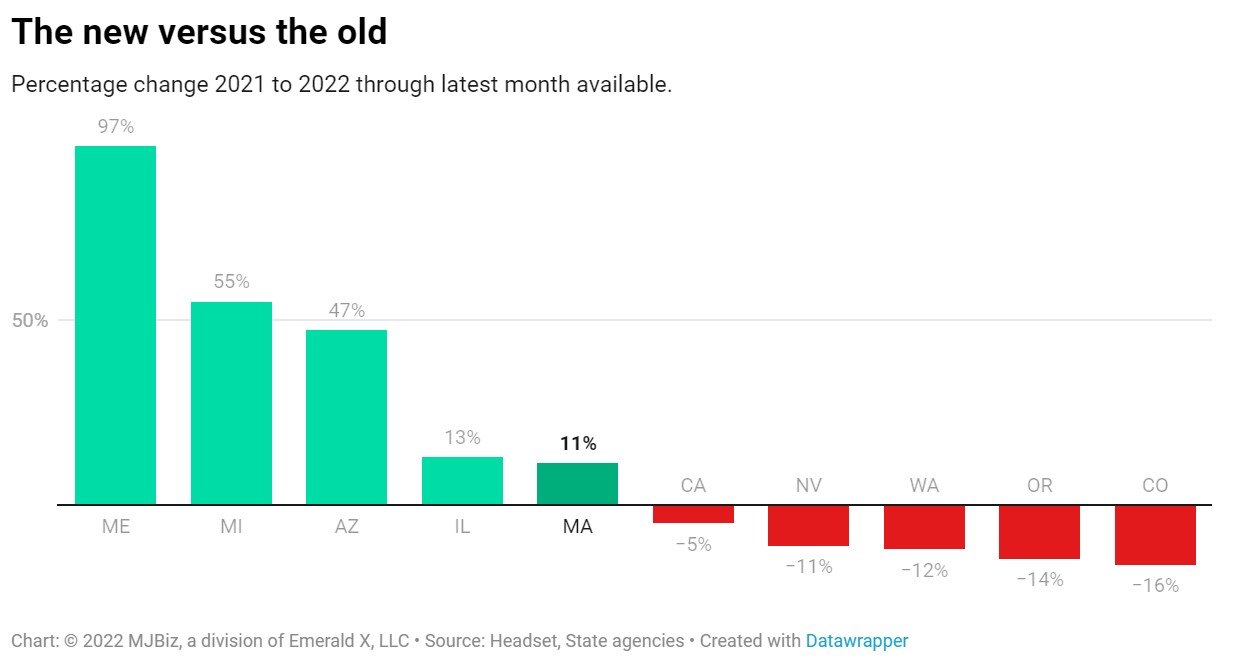

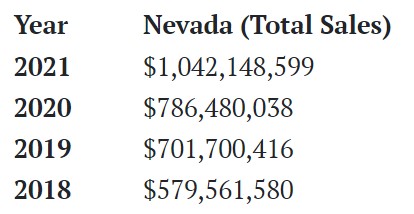

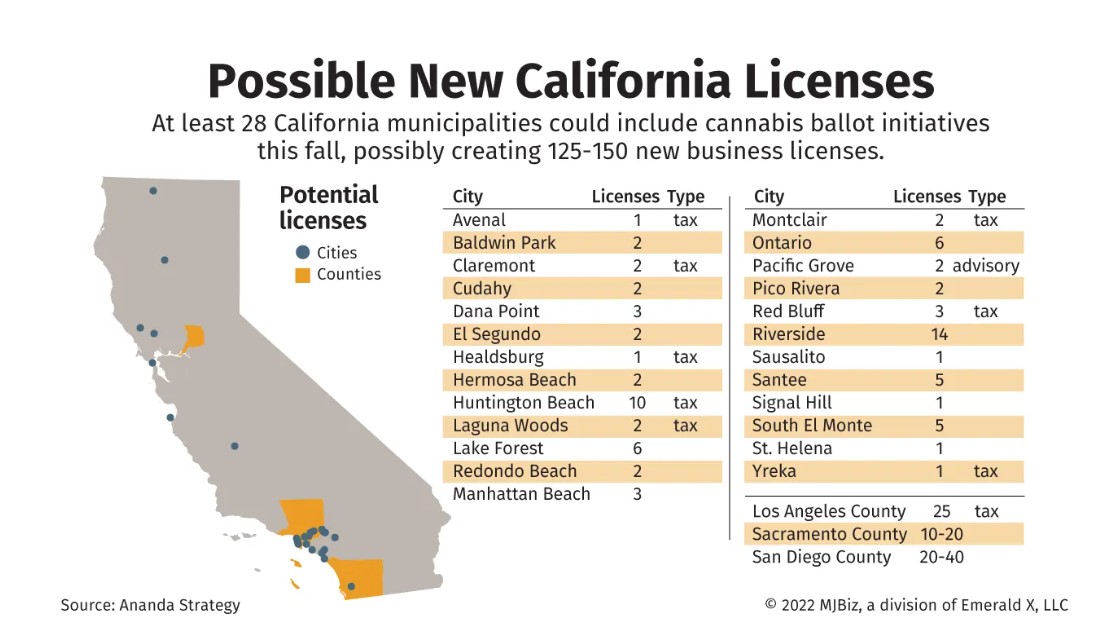

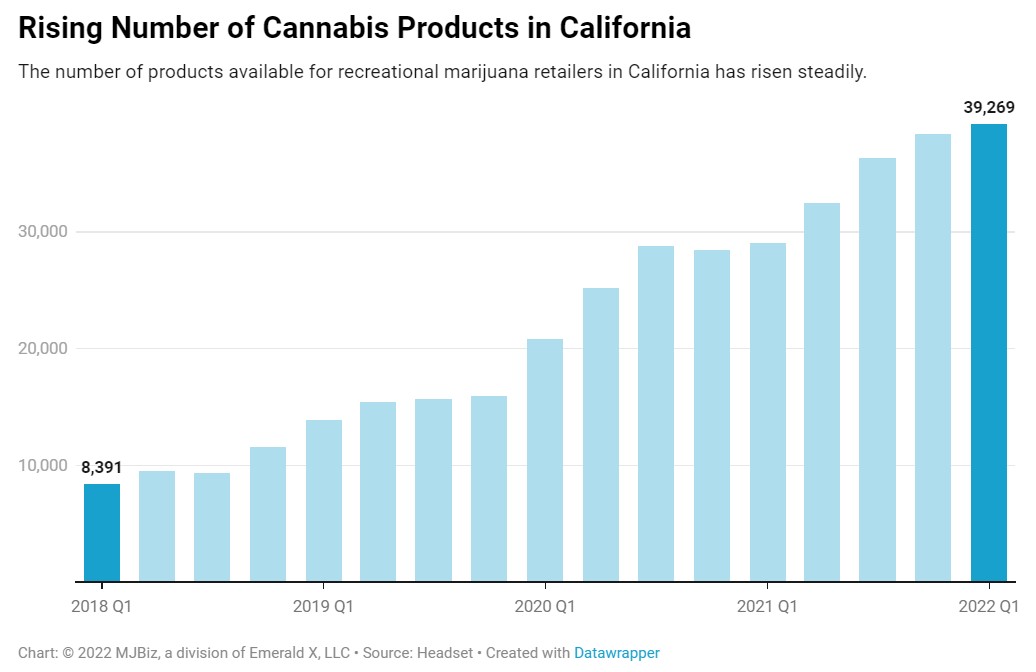

Annual cannabis sales in California declined in 2022 for the first time since the state launched its adult-use market five years ago, according to state data analyzed by MJBizDaily.

Retailers generated just over $5.3 billion in taxable sales of recreational and medical marijuana last year, down 8.6% from roughly $5.8 billion in 2021, according to the latest statistics released by the California Department of Tax and Fee Administration.

Taxable sales in the fourth quarter dipped to about $1.3 billion – the third straight quarterly decline – down nearly 12% from the same period a year ago.

Depressed wholesale prices, which have made products cheaper for consumers, and the continued lack of retail outlets across wide swaths of the state have been two big drivers of this trend, according to California cannabis industry consultant Hirsh Jain.

“California’s ‘dual-licensing’ system has made it very difficult for new dispensaries to open in the years since adult-use sales began,” said Jain, the principal of Los Angeles-based Ananda Strategy.

Under California rules, cannabis businesses must obtain local authorization from the city and/or the county in which they operate before they can apply for a state license.

This system has caused major delays in issuing annual licenses since the launch of adult-use sales in 2018.

Those delays continue to plague operators throughout California, including Mendocino County.

Marijuana growers there are asking state regulators to intervene because the local government has failed to “establish a process capable of moving good-faith cannabis operators towards state annual licensure,” the Mendocino Cannabis Alliance claimed in a Feb. 8 letter to California Gov. Gavin Newsom and Department of Cannabis Control Director Nicole Elliott.

“This has artificially limited the size of the state’s legal cannabis market, causing it to prematurely plateau and now regress,” Jain added.

The state’s illicit market, which some industry insiders estimate is double the size of the regulated industry, has also played a role in stumping sales at licensed stores, a trend that materialized during the medical marijuana era, years before California voters legalized possession and adult-use sales in November 2016.

California cannabis businesses generated nearly $1.1 billion in taxes in 2022, down 21% from roughly $1.4 billion in 2021.

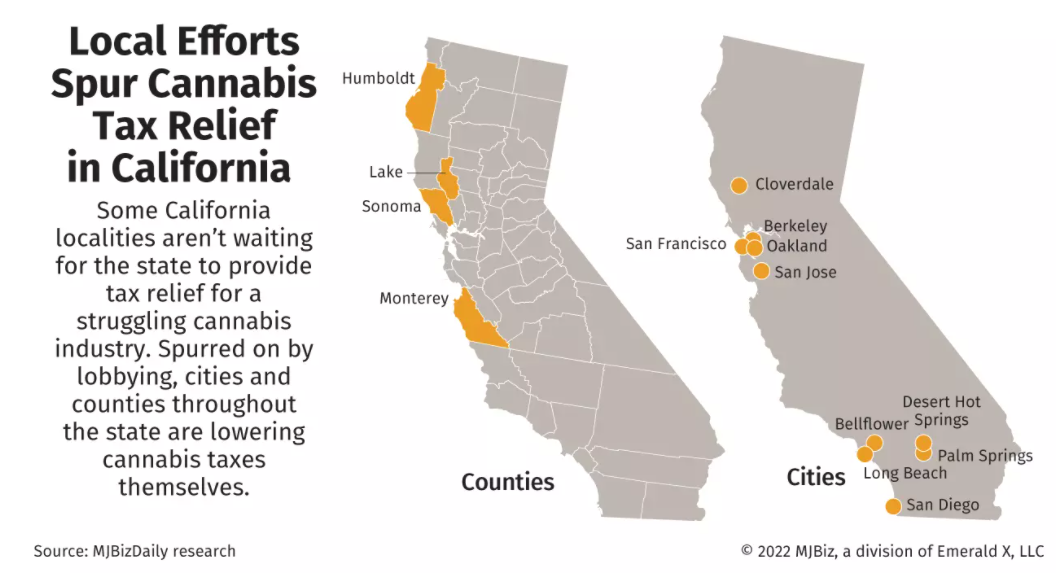

The decline partially stemmed from the elimination of the state’s cultivation tax on July 1, the start of the fiscal year, as well as the aforementioned economic and regulatory challenges.

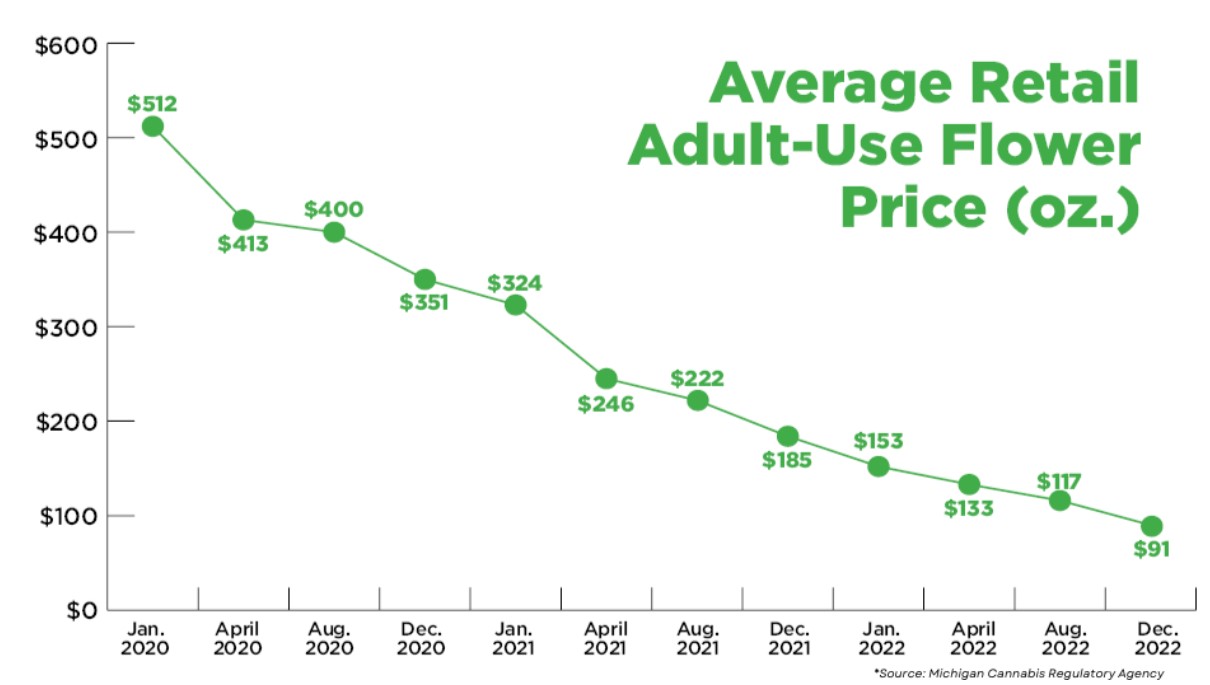

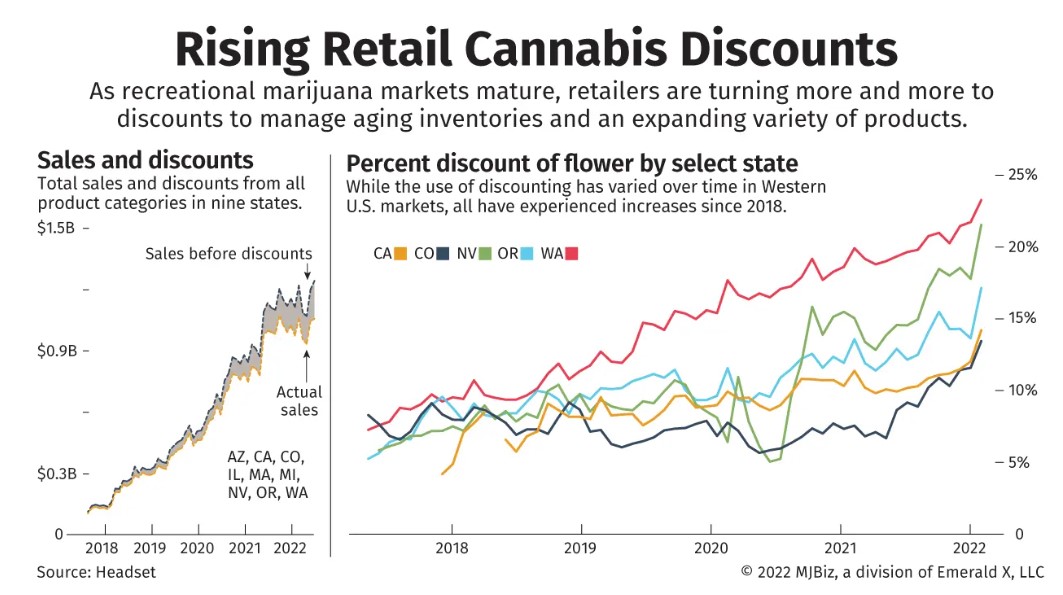

It’s no secret that price compression has become a significant challenge for cannabis operators over the last several months.

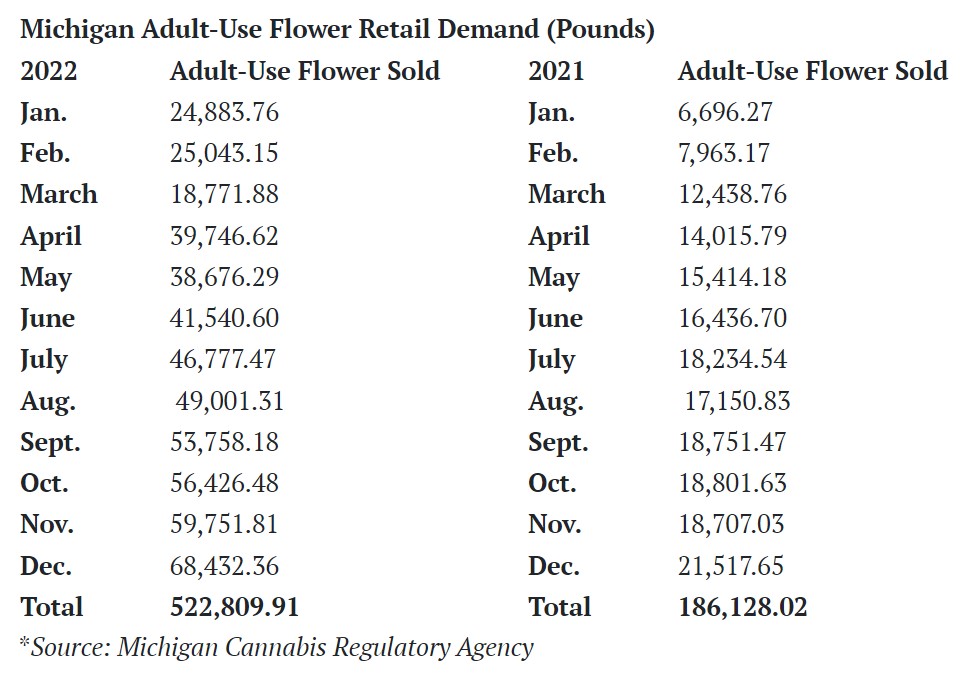

One market that has taken a hit with plummeting prices is Michigan. In December 2022, the average retail price for an ounce of adult-use flower dropped to $91—an all-time low for the state's market. That number is a 51% decrease compared to $185 per ounce in December 2021 and a 74% decrease compared to $351 per ounce in December 2020, according to monthly sales figures from the state’s Cannabis Regulatory Agency (CRA).

Despite prices declining significantly in Michigan, consumer demand has increased, and sales figures are record-breaking—leaving some to wonder about the forces behind Michigan's plummeting prices.

Race to the Bottom

Will Bowden, CEO of Grasshopper Farms, a Michigan-based premium sun-grown cannabis provider, says while there is no softening of demand in Michigan, the retail price per ounce and wholesale price per pound of flower is decreasing.

Bowden says one factor impacting prices could be that operators have trouble navigating a "transition period," which typically happens between years three and six of legalization, he says. Michigan launched adult-use sales in December 2019.

"So, when a market comes online, there is typically a natural occurrence where there is greater demand than supply. So that keeps the prices abnormally high, and that's why a lot of operators really seek to get into that year one and year two opportunity in any newly regulated state," he says. "But what I think happens is people don't always have their plan for the transition period. … and what happens is supply will eventually catch up to demand, and then you'll have people who will start having price wars so that they can try to carve out their piece of their market share."

He says this leads to that "race to the bottom," particularly at the wholesale level. According to Cannabis Benchmarks, Michigan's spot wholesale flower price averaged nearly $2,750 a pound in January 2021 and dipped 66% to $925 per pound in October 2022. That number increased slightly in December 2022 to $1,036 per pound, but so far in February has averaged $995 per pound.

"I'll focus on flower for a second, but this happens with all the products out there. So basically, what will happen is all the cultivators, regardless of discipline, indoor greenhouse or outdoor, will start dropping their prices down just to stay on shelves, and it gives a tremendous amount of power to the retailers to negotiate," he says. "The main thing that will impact that negotiation is consumer demand. So that's one of the things in the race to the bottom that happened, just pure supply and demand."

Bowden adds that operators may not be prepared to navigate normalized wholesale prices, which, in turn, causes them to sell the product at a lower price than the cost to produce it.

"They're losing money just to keep shelf space, and they think they'll be able to raise the price later," he says. "It's very hard to raise your prices later. When you lower your price, you've actually just set your new price. ... That's my philosophy."

Market Event

Bowden says another factor that can impact prices is a "market event."

He referred to one of the largest cannabis product recalls in Michigan to date, which happened on Nov. 17, 2021, when the state's Marijuana Regulatory Agency (MRA)—now the CRA—recalled more than $200 million in products tested by Viridis Laboratories between August and November 2021. At the time of the recall, that lab was testing as much as 60% to 70% of the products on the market, Cannabis Business Times reported.

The recall led to a court case where Virdis Laboratories sued the MRA and said it was "unjustified, prejudiced and retaliatory," CBS News reported. On Dec. 3, 2021, "Michigan Court of Claims Judge Christopher Murray granted Viridis Laboratories a preliminary injunction for a recall of products that one of its labs tested but denied a preliminary injunction for a recall at another of the company's labs." This decision led to nearly half of the recalled products being released, CBT reported.

Despite this, Bowden says the initial recall caused a lot of chaos among operators, as many were worried that they would not only be competing with other recalled product, but also product that wasn’t subject to the recall.

"So that created this panic, and prices dropped,” he said, adding that the price per pound for flower dropped from between $1,500 and $2,000 a pound to $300 and $600 a pound.

“That was more of a market event,” he says. “But at the same time, suppliers were producing enough to compete with each other. So, it's kind of a perfect storm.”

Bowden says that while he doesn't think the product recall is still impacting the market, it may have triggered that race to the bottom.

"It accelerated normalization and maybe a little bit beyond normalization ... but the way that at least supply works, your indoor growers are trying to turn five or six times a year, your pure outdoor growers maybe one time a year. We've cleared both of those hurdles, since then, so we're well beyond that market events supply, or the subject of that supply being an influence on today's market, but I don't think we would be where we are today without that market event," he says.

Increasing Supply and Demand

The number of cultivators in Michigan has also increased significantly in the past year, leading some to believe that oversupply is impacting prices.

For example, as of December 2022, Michigan had 825 active grower licenses for its adult-use market, as well as 133 excess grower licenses held by many of the largest companies in the state, according to CRA’s December 2022 report. Those numbers are almost double compared to December 2021, when there were 518 active grower licenses and 59 excess grower licenses.

"This is where it gets a little harder because the reports that Michigan puts out, they'll tell us how many cultivators are out there, but they're not saying what each cultivator is doing with their product, meaning most of the outdoor farms are pure biomass farms because they're not able to actually grow flower that's going to be able to sell out there at a price that makes sense for them," Bowden says. "So that's one thing we must consider when talking about this."

He says that the CRA's reports also don't show which cultivators may be slowly ceasing operations.

"It's hard to predict some of those things at this stage in the market," he says. "I think what's happening is that starting with that recall, we started the clock on an 18- to 24-month window in which people are going to exit out slowly. They're just trying to grab revenues before they do with existing products, existing growth, things like that. I think that this year will be the last outdoor grow for some of the folks who are doing outdoor grow. I think that we're going to see a change in that."

While there is an increase in supply, there's also a significant increase in demand, aside from the medical market, Bowden says. For example, Michigan retailers sold a record high of cannabis products in December 2022, bringing in $221.7 million—with more than $208 million coming from adult-use sales, CBT reported.

Furthermore, CBT reported that Michigan's total medical sales for all of 2022 declined almost 47% from 2021, which is also tied to falling prices.

"The caregiver numbers are declining because the price of cannabis has gotten so inexpensive at the retail marketplace [that] it's now cheaper to actually purchase cannabis than it is to cultivate it and grow it yourself," Rick Thompson, owner of the Michigan Cannabis Business Development Group and executive director for Michigan NORML, recently told CBT. "So, people that were utilizing the privilege of growing in order to save their patients money are no longer doing that; it's not advantageous."

As the average flower price per ounce continued to decrease, the number of qualified caregivers and patients started to dwindle. As of Dec. 31, 2022, there were 179,863 qualifying patients and 19,053 primary caregivers approved in Michigan—a significant decrease compared to Jan. 31, 2020, where there were 267,068 patients and 36,136 caregivers, according to CRA data.

Despite this, the increase in consumer demand continues to outpace the falling dispensary prices. For example, adult-use retailers sold 68,432 pounds of flower in December 2022 and nearly 523,000 pounds of adult-use flower in total for 2022—representing a 181% increase compared to 2021, CBT reported.

Navigating the Market

To navigate this market downturn, Bowden says that Grasshopper Farms has worked to differentiate itself in the marketplace and focuses on creating high-quality products for its consumers.

"First and foremost, you have to deliver a great product that is accepted by your retailers and accepted by the consumers," he says. "You have to talk to both of those groups differently to make sure they know who you are, what you're doing, and know what to expect when they get your product."

Bowden adds that product consistency is key and that your retailers and consumers should always know what to expect when they purchase/consume your product.

Moreover, he stresses the importance of being strategic with your pricing strategy.

"So while there are farms out there who are selling somewhere around $350 a pound, we have never dropped our prices below the $500 to $700 range depending on the quantity that they are buying because we're confident in our product, and consumers at this point are confident in our product too," he says. "All of the retailers we sell to, they sell out in four to six days after they get our product, and that's regardless of the quantity that they have on their shelves."

He also mentions that a solid business model is crucial as supply continues to increase.

"I do not think that we have too much supply in the state of Michigan; I think that there's plenty of space for people," he says. "It's a matured market now, even though it's still young, it's matured, which means now you've … got to have a business plan; you've got to have a sales and marketing plan; you've got to have a plan for your inventory, and how you manage your inventory."

Bowden says he thinks Michigan operators will either start to stabilize or exit this year.

"I think we'll start to see if the prices might change a little bit based on operators who are able to sustain a viable business," he says. "I don't know how much further the wholesale price will go up. It might just kind of sit where it is right now, but I don't think it'll go down more, though, at this point.

"I think that what's going to happen is, if there is anybody else who comes in and tries to saturate the market, I think they're going to have to make a name for themselves, and this is where that sales and marketing plan better be a part of your business plan. And you better be able to speak about your company so that people know what they're getting. And then you have to be consistent with your supply."

Hemp-derived synthetic forms of THC, the psychoactive element in cannabis, do not meet the federal definition of hemp and are therefore controlled substances, the U.S. Drug Enforcement Administration (DEA) has asserted.

The agency’s statement on delta-8 THC-O and delta-9 THC-O is the latest input into the ongoing debate in the USA sparked by the proliferation of delta-8 products, which are widely available in convenience stores and smoke shops in the absence of a clear understanding of their potential effects on consumers.

Made in the lab

Delta-8 and delta-9 THC naturally occur in hemp but only in trace amounts. Producers have turned to the laboratory to make products with higher concentrations of the two THC forms, both of which are based on CBD produced from hemp.

“Delta-9-THCO and delta-8-THCO are tetrahydrocannabinols having similar chemical structures and pharmacological activities to those (naturally) contained in the cannabis plant,” Terrence L. Boos, head of the DEA’s Drug & Chemical Evaluation Section, wrote when queried about the two forms of THC in a letter from Rod Kight, a North Carolina-based cannabis attorney.

Producers started making delta-8 THC products amid the drastically diminished fortunes of the CBD sector, where demand did not reach inflated expectations and oversupply caused prices to plunge by as much as 90% over the past three years. Some analysts have said at least 75% of the current supply of CBD is going into the production of unregulated delta-8 products.

Gaps in law

Federal lawmakers failed to account for synthetic forms of THC produced from CBD when they legalized hemp through the 2018 Farm Bill. Under that measure, hemp-derived products are not subject to the same THC testing requirements as marijuana. Producers have argued that because the Farm Bill made hemp and its downstream products legal, delta-8 is therefore also legal. A U.S. appeals court ruled last year that a strict interpretation of the Farm Bill makes delta-8 legal, noting that lawmakers can correct that situation with further legislation.

Opponents suggest the Farm Bill never intended hemp to be used to make psychoactive compounds and that nefarious players are exploiting the bill’s language to sell highly potent synthetic THC products that are often rife with contaminants, inaccurately labeled, and marketed in manners that could be appealing to children.

“It has always been my view that THCO is a controlled substance under federal law,” Kight said in a recent blog post. “Although it can be made from cannabinoids from hemp, THCO is not naturally expressed by the hemp plant. It is a laboratory creation that does not occur in nature, at least not from the hemp plant.”

Landscape unfolding

In the absence of federal rules, some states have outlawed delta-8 THC altogether while others are treating it under rules for products that carry delta-9 THC naturally derived from marijuana plants.

Meanwhile, CBD, the base material for both forms of synthetic THC, itself remains unregulated by the federal government, although some states are establishing local rules for the compound. The U.S. Food and Drug Administration (FDA) last month called on Congress to set a framework for CBD through legislation, saying current federal safety standards are insufficient to manage the products.

In a major policy shift, Twitter is allowing “approved” and state-legal cannabis companies and other advertisers to post ads in the U.S. for regulated THC and CBD products, accessories and services, the social media platform has disclosed.

“We permit approved Cannabis (including CBD– cannabinoids) advertisers to target the United States” provided a slew of conditions are met, Twitter said on its website under the heading, “Drugs and drug paraphernalia.”

AdCann, a cannabis marketing and advertising website based in Toronto, first reported the development in a social media post.

AdCann noted that, “effective immediately,” Twitter will permit “advertisers to promote brand preference and informational cannabis-related content” for certain products and services, including:

CBD and similar cannabinoid products.

THC and similar products.

Cannabis-related products and services, including delivery services, labs, events and more.

“American cannabis companies, brands and purveyors will need to pass through a Twitter advertiser approval process to ensure they are legitimate and educated on the platform,” AdCann reported.

“Once approved, industry marketers will have access to Twitter’s entire suite of advertising products including promoted tweets, promoted product opportunities, location-specific takeovers, in-stream video sponsorships and partner publication features.”

Cannabis industry executives welcomed the news.

“This has been in the works behind the scenes for a while,” Patrick Rea, the managing director at San Francisco-based venture capital firm Poseidon Garden Ventures, said in a tweet Tuesday night.

“Cannabis is a leading topic on @Twitter and should be a big channel for #cannabis advertising, depending on the details of the program. #progress,”

Rosie Mattio, CEO of Mattio Communications, a cannabis-focused marketing and communications firm in New York City, tweeted: “Kudos to @twitter for being the first major social network to welcome Cannabis advertisements.”

Under its new guidelines, Twitter said that cannabis advertisers – presumably companies – will be subject to a variety of restrictions and conditions:

- “Advertisers must be licensed by the appropriate authorities, and pre-authorized by Twitter.

- “Advertisers may only target jurisdictions in which they are licensed to promote these products or services online.

- “Advertisers may not promote or offer the sale of Cannabis (including CBD– cannabinoids). Exception: Ads for topical (non-ingestible) hemp-derived CBD topical products containing equal to or less than the 0.3% THC government-set threshold.

- “Advertisers are responsible for complying with all applicable laws, rules, regulations, and advertising guidelines.

- “Advertisers may not target customers under the age of 21.”

The sudden change in policy comes after billionaire Elon Musk completed his purchase of Twitter last October, buying the social media service for $44 billion.

Musk is well known for having smoked marijuana on Joe Rogan’s podcast in 2018.

Insider later reported that Musk – the CEO of space company SpaceX – was afterward ordered by the U.S. government to undergo random drug testing for a year.

SpaceX does considerable business with the federal government.

Musk’s purchase of Twitter immediately fanned speculation that the billionaire would loosen Twitter’s strict advertising policy governing marijuana.

“Up until now, only CBD topical brands were permitted to advertise on Twitter’s platform,” AdCann noted in its social media post.

“Moving forward – the social network will allow for the promotion of regulated THC and CBD-containing cannabis products, accessories, services and more.”

In its new guidelines, Twitter made clear it would not allow advertising directed toward minors.

The company also laid out several other restrictions, saying cannabis ads must:

- “Not appeal to minors in the creative, and landing pages must be age gated and sales must be age verified.

- “Not use characters, sports-persons, celebrities, or images/icons appealing to minors.

- “Not use minors or pregnant women as models in advertising.

- “Not make claims of efficacy or health benefits.

- “Not make false/misleading claims.

- “Not show depiction of cannabis product use.

- “Not depict people using or under the influence.

- “Not encourage transport across state lines.”

Twitter’s move comes on the heels of January announcement that Google Ads will no longer ban all hemp and CBD advertising in California, Colorado and Puerto Rico.

However, there will continue to be limitations to marketers, Google added in its blog post.

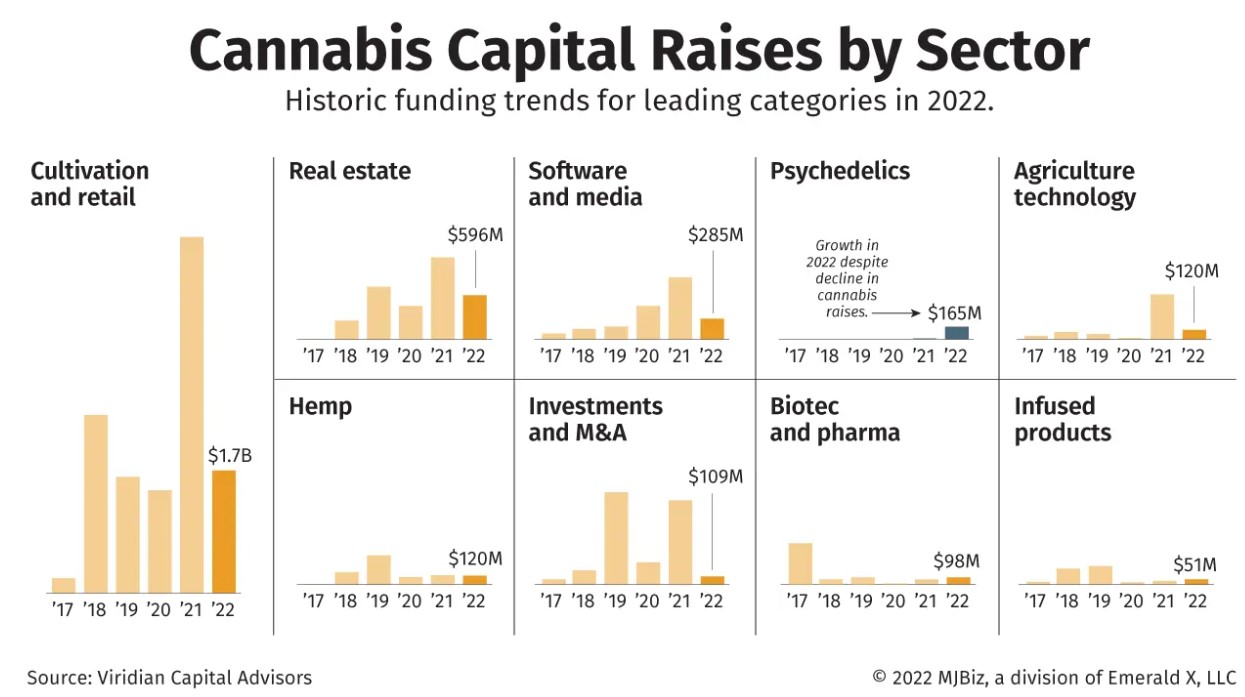

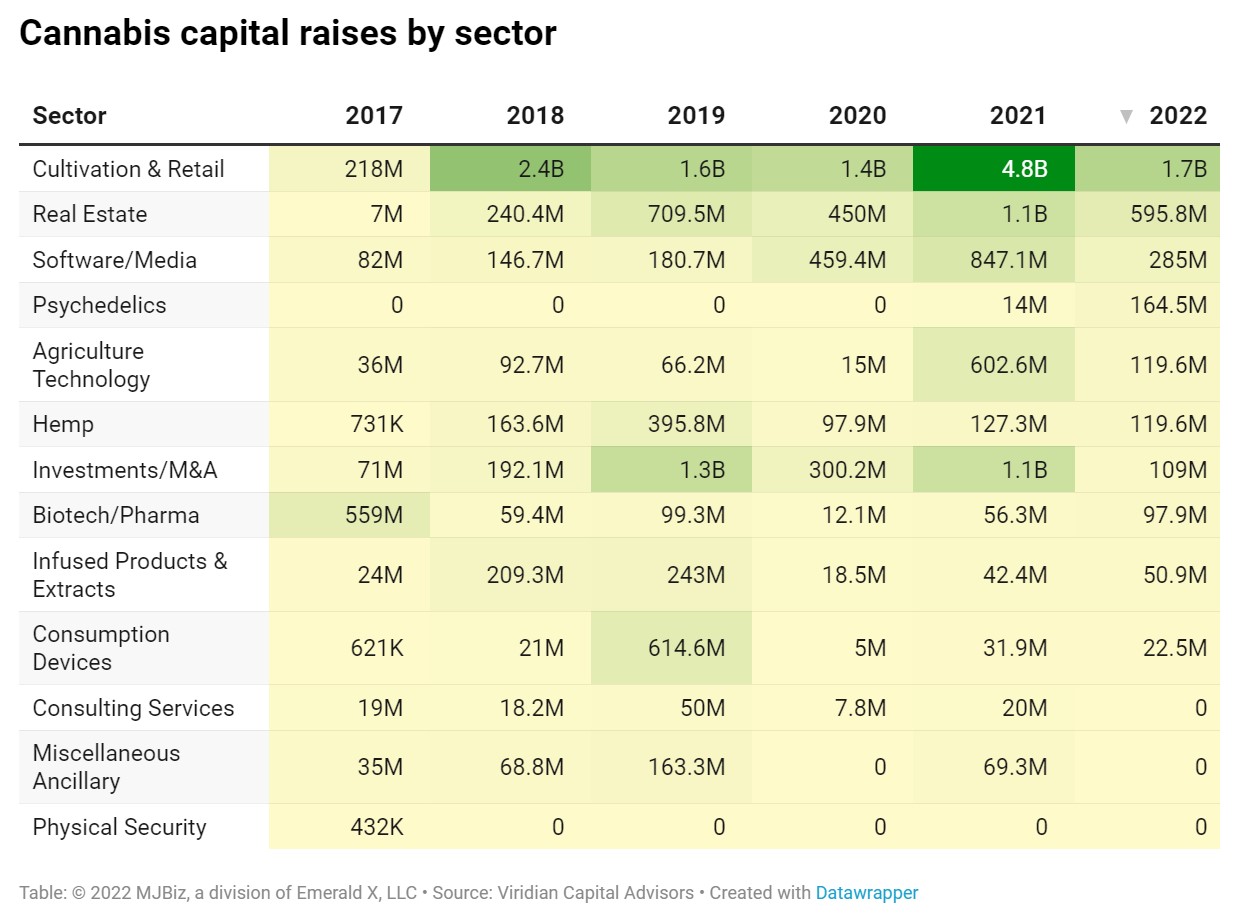

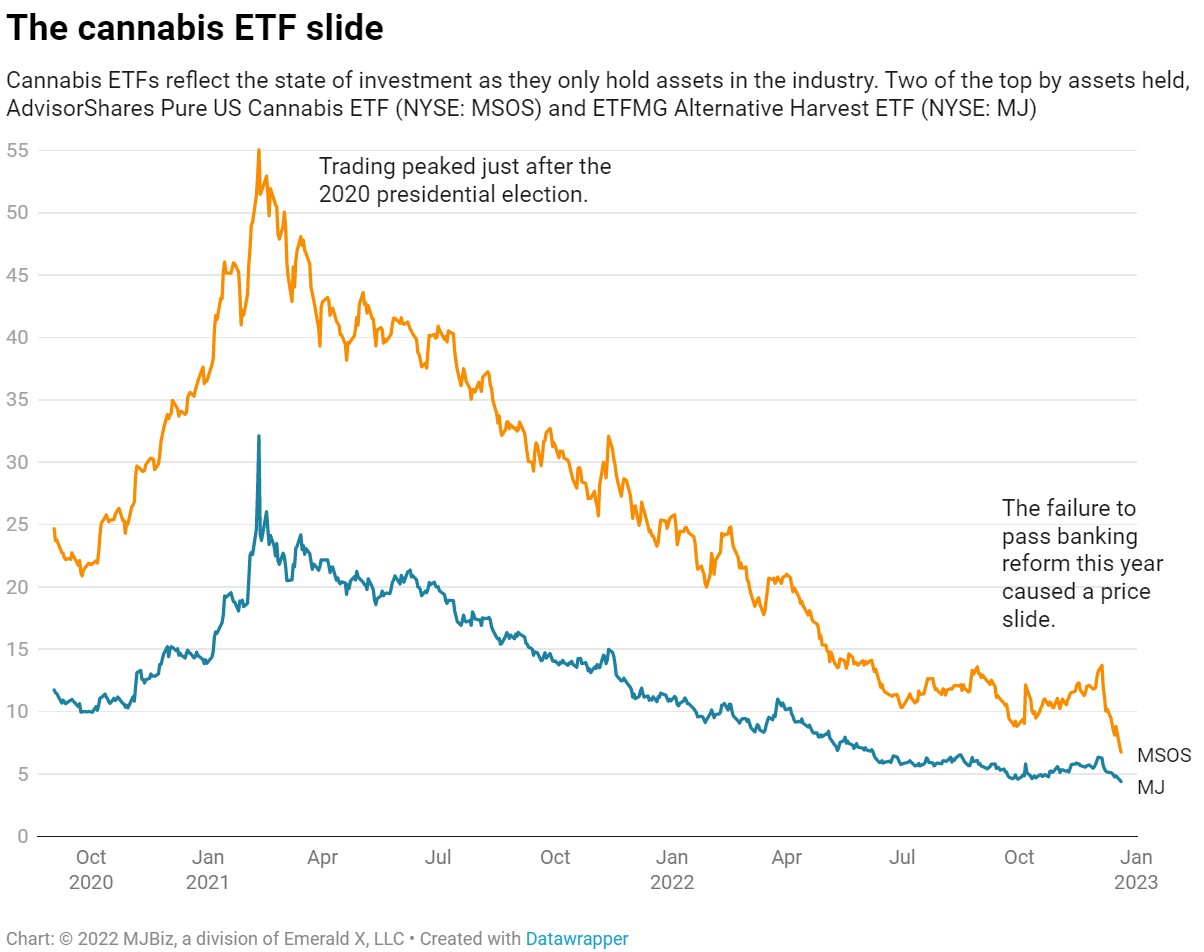

Many marijuana companies seeking capital are expected to find limited pickings and costly terms this year, providing little relief from 2022, when the amount of money ponied up by investors tumbled more than 60% from the year before.

Still, investors are expected to open their checkbooks for certain types of businesses and opportunities.

Analysts pointed to M&A deals aimed at scooping up distressed assets as well as ancillary businesses that often require less money to operate than plant-touching companies such as cultivators and retailers.

On the flip side, these same plant-touching businesses will likely face more obstacles raising capital, according to analysts.

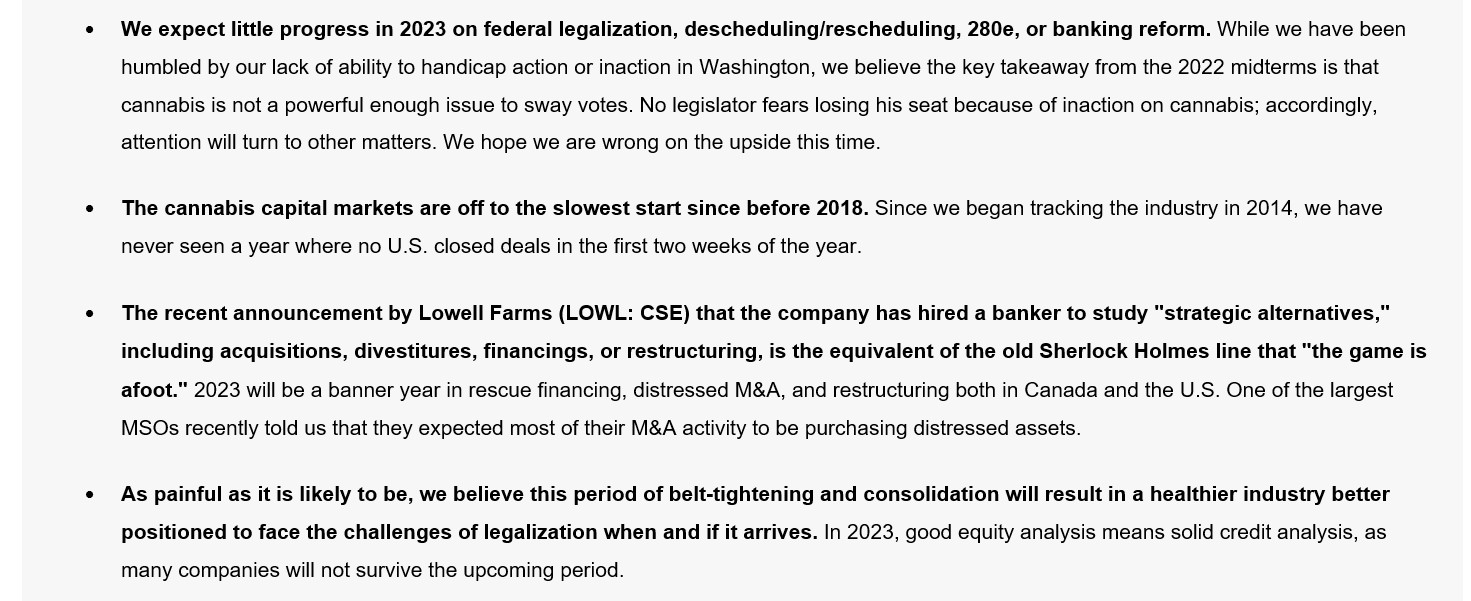

Last year, nearly every cannabis sector tracked by Viridian Capital Advisors – from M&A to cultivation to real estate – saw steep declines in capital raises compared to 2021’s capital markets boom, which was driven by sales growth, less expensive capital and hopes for federal reform.

Just biotech/pharma, infused products and extracts and psychedelics grew in 2022. (Viridian, a New York-based capital, M&A and strategic advisory firm, started tracking psychedelics as a counterpoint to cannabis.)

“The equity side of the capital markets just completely went away at the end of last year for U.S. cultivators,” Frank Colombo, director of data analytics at Viridian, told MJBizDaily.

“And for the first three weeks of 2023, we had no debt deals, which was really surprising to me because that was the thing that was holding the market up.”

That’s until Massachusetts-based multistate cannabis operator MariMed announced in January it had secured a $35 million credit facility from lenders Chicago Atlantic Advisors and Silver Spike Investment Corp.

“It was good news because it showed that even medium-sized companies can still get debt capital,” Colombo said.

High cost of capital

On the other hand, Colombo said, the terms of the deal also show how expensive capital is and how important it is for that capital to be allocated strategically.

MariMed will receive $30 million at close with the option to borrow another $5 million over the next six months.

The loan carries a floating interest rate of the prime rate plus 5.75%, with 30% warrant coverage.

“I come from a high-tech background, so it took me a while to get over what the price of lending is in cannabis,” MariMed Chief Financial Officer Susan Villare told MJBizDaily.

“Never in my career had I done debt financing over 10%.”

But when Villare looked at the rates other players were paying in refinancing deals, the fact that the SAFE Banking Act failed to pass Congress and what MariMed could achieve with the $35 million, she decided it was the right deal.

After listing on the Canadian Securities Exchange last July, MariMed announced its $20 million acquisition of Maryland medical cannabis business Kind Therapeutics.

The deal came shortly before Maryland voters overwhelmingly approved adult-use marijuana legalization last November.

MariMed also plans to expand operations in Illinois, Massachusetts and Missouri.

“We could certainly do it with cash flow from operations. But we said, 'Hey, let’s accelerate that,'” Villare noted.

“We’ll do the secured financing to get that done. It’s pretty short term - three years - and we’re confident with cash flow from operations that we can pay it down, and we did negotiate hard to ensure that there would be no prepayment penalties should we pay it all down after 20 months.”

Growth opportunities

Both Colombo and Patrick Rea, the managing director at San Francisco-based venture capital firm Poseidon Garden Ventures, said they expect cultivators and cannabis license holders to pay a premium for capital and struggle to secure investment through 2023.

Even though software and media companies have been downsizing and, in the case of Denver-based Akerna Corp., exiting the industry entirely, non-plant-touching ancillary services are scalable, without the burden of licensing.

“I find a lot of the investors I spoke with are really just focusing on ancillary technology and taking a break from licensed operations because what we’ve learned about licensed operations is that they’re capital intensive. It takes a lot of money to get them up and going,” Rea told MJBizDaily.

“And when cannabis regulators and legislators realize that the sky didn’t fall and there’s no zombie apocalypse (after legalization), they issue more licenses. And every additional license they put out decreases the value of the existing licenses because there’s more competition.”

Colombo said more funds will likely be created with the purpose of raising money to invest in financially struggling operations and companies.

“We’ve both talked to people and heard secondhand of other groups trying to raise money to pursue acquisitions of distressed properties,” he said.

Similar to predictions that M&A would be dominated by acquisitions of distressed assets in 2023, capital raises will also go toward either distressed asset acquisitions or rescue financing for companies struggling to stay afloat.

Psychedelics

One area that is attracting investor dollars is the psychedelics business.

Viridian started tracking capital raises in psychedelics because the company was noticing the flood of capital going into the sector, Colombo said.

"So it's an incredible counterpoint that shows businesses that have incredible growth potential like cannabis," he said.

"And it's further behind the curve in terms of development of actual revenues."

"But it's way, way ahead of the curve in terms of regulatory approval," Colombo said, because some psychedelic drugs used in treatment clinics such as ketamine aren't Schedule 1 drugs.

That means the sector is perceived as less risky, with lots of opportunity for capital raises and M&A.

"If you had asked me three or four years ago if psychedelics would be more legal than cannabis, I would have said, 'What are you, crazy? You must be joking.'

"But that is indeed how it has transpired."

A much-hyped letter from California cannabis regulators to the state’s attorney general raises an intriguing question: Is the Golden State teeing up interstate trade in marijuana?

Top officials from the state’s Department of Cannabis Control (DCC) on Jan. 27 sent an eight-page letter to the office of California Attorney General Rob Bonta, laying out the legal argument for how California could sidestep federal obstacles if state officials decide to green light exports of cannabis across state lines.

The letter raised eyebrows among marijuana executives and legal experts, with industry players calling it a major development – but one that would take time, if it ever does come to fruition.

One key sticking point: California would need to find another state willing to take its marijuana, said Hirsh Jain, a California-based cannabis consultant.

“I know that there’s a lot of excitement,” he added. “But if you really think through the mechanics here, it’s unlikely anything will happen this year.

“California needs a dance partner.”

In their letter to the attorney general, the DCC’s executive director, Nicole Elliott, and general counsel, Matthew Lee, asked Bonta to issue an opinion on whether exporting marijuana to another state would “result in significant legal risk to California” under the federal Controlled Substances Act.

Elliott and Lee, for their part, argued “it will not.”

They noted the Commerce Clause of the U.S. Constitution bars Congress from restricting how states regulate their own interstate commerce.

Marc Hauser, principal of Hauser Advisory, a California-based consulting firm, sees this as another step in normalizing marijuana commerce across the country.

“It’s a big deal and important for the industry,” he said.

This comes after California Gov. Gavin Newsom in September signed Senate Bill 1326, which would create interstate commerce pacts if only one of the following criteria are met:

- Federal legalization, which is not imminent.

- A U.S. law is enacted that bars the federal government from spending money to prevent interstate marijuana shipments.

- The U. S. Department of Justice issues an opinion or memo allowing interstate marijuana commerce.

- The U.S. attorney general issues a written opinion that state law pursuant to medical or adult-use commercial marijuana activity will not result in “significant legal risk to the State of California under the federal Controlled Substances Act, based on review of applicable law, including federal judicial decisions and administrative actions.”

‘Bull by the horns’

Other states have taken steps to permit interstate commerce, though most depend on changes to federal cannabis law:

In Oregon, a recently filed lawsuit challenging state law could help move the needle to allow state-to-state sales.

New Jersey Senate President Nicholas Scutari filed a bill in August that would permit the governor to authorize interstate marijuana trade.

Washington state lawmakers approved a bill in January that would allow interstate marijuana commerce if federal law changes.

For large-scale growers such as vertically integrated California cannabis company Glass House Brands, the move could prove profitable.

“This makes all the sense in the world,” said Graham Farrar, president of the Santa Barbara-based business.

“The fact that California – the fifth-largest economy on the planet and the largest cannabis economy in the world – is taking the bull by the horns and saying, ‘We want to make progress to get consumers what they want by growing plants in the right environmental place.’ … This is awesome,” he added.

Farrar noted that the states – versus Uncle Sam – have spearheaded major developments in marijuana reform, from medical cannabis legalization to adult-use markets.

“Literally 0% has been led by the federal government,” he added.

“So there’s no reason to think that interstate commerce is going to be any different.”

Not so easy

However, while California’s move signals another step toward allowing cannabis companies to sell marijuana beyond state borders, the logistics of how it could work are unclear.

California’s Emerald Triangle region has long supplied the country’s illicit market with outdoor-grown cannabis, and some of those growers have gone legit and operate in the legal market.

Those cannabis growers would like to see the entire country opened up to legal trade to help ease overproduction.

And they would also like to establish an appellations program where California cannabis is treated and marketed much like France’s famed bubbly, Champagne.

But right now, if California could find a willing commerce partner, it would have to be a bordering state since marijuana air travel is regulated at the federal level.

But that, too, could prove problematic.

Oregon’s market is glutted. And there no signs that Arizona or Nevada need additional cannabis.

Another key wrinkle: Why would any state forgo the tax revenue and jobs and economic benefit of growing and manufacturing marijuana within its own state?

“The states are going to very strongly oppose this, whether it’s done politically or it’s done through the courts,” Hauser said. “Because they want to retain those tax dollars.”

He pointed out the states with mandatory vertical integration wouldn’t want this because it would disrupt the entire business-licensing structure.

“It becomes a lot more competition for the cultivators and manufacturers within the state,” Hauser said. “It can create a race to the bottom.”

That’s a problem the industry is already experiencing, as mature recreational cannabis markets across the country report falling prices and oversaturated flower sectors.

Could take time

Although a few other states with legal marijuana markets have taken steps to set up interstate trade, most have not.

Even if California does get that partner to dance, that state must agree to all the terms in SB 1326.

Among other things, the new law stipulates that the partnering state must meet all the same standards as California’s cannabis market, including testing, packaging and labeling.

“That’ll be a real obstacle,” Jain said.

“Just imagine a world in which California imposes really rigorous sustainability requirements on its cultivators, then it will have to impose those requirements on cultivators in other states or it will get a lot of flak right from its own cultivators.”

And if California’s cannabis market is known for anything, it’s for being the most heavily regulated market in the country.

“There’s going to be many diverse interests in both states that have different takes on these questions,” Jain said.

“And that will slow down the process of establishing agreements.”

Jain added that even after the governor comes to an agreement, he must submit it to a legislative committee that has 60 days to look at it and provide feedback.

Then the agreement must be posted on the state website for 30 days.

“This will take a really long time,” Jain said. “This is a signaling of the trickle that is to come that will take many years to actually build into a river.”

Saying federal safety standards are insufficient to manage the CBD industry, the U.S. Food and Drug Administration (FDA) has called on Congress to set rules for the products through legislation.

The agency said Thursday that not enough is known about CBD products to regulate them as foods or supplements under the FDA’s current structure.

“A new regulatory pathway would benefit consumers by providing safeguards and oversight to manage and minimize risks related to CBD products,” FDA Deputy Commissioner Janet Woodcock said in a statement.

Same old song

FDA has repeatedly cited studies that say CBD could harm the liver and male reproductive system, and said little is known about how it interacts with drugs, and its effects on children and pregnant women.

Hulled hemp seeds, hempseed oil, and seed-based protein powder are allowed as ingredients in human food by the FDA. But CBD, which is derived from hemp flowers, is not.

In calling for Congress to act, the agency said its existing foods and dietary supplement authorities are not able to manage many of the risks associated with CBD under rules for dietary supplements and food additives. “Given the available evidence, it is not apparent how CBD products could meet safety standards” for such products, FDA said in the statement.

Petitions rejected

The FDA underscored its position on CBD by simultaneously announcing it had denied three petitions from stakeholder groups that had asked the agency for rules that would have allowed the marketing of CBD products as dietary supplements.

Lawmakers and CBD stakeholders have repeatedly called out the FDA for its inaction on CBD. The Oversight Committee of the U.S. House of Representatives had said recently that it was preparing to investigate the agency over its regulatory jurisdiction.

Instead of supporting CBD research and making rules, the FDA has mostly cracked down on vendors with repeated waves of warning letters over the last few years.

FDA said recently that it is only months away from finalizing some recommendations for how cannabis should best be regulated, and called for a framework “that balances individuals’ desire for access to CBD products with the regulatory oversight needed to manage risks.” The agency said Thursday it will work with Congress to develop a cross-agency strategy for regulation.

The lack of rules for CBD, long-awaited by stakeholders, is a factor in stalled investment in the sector, which at any rate is massively downsized as a result of a crash that has lingered for more than two years. Interest in the sector could be revived if federal rules allow hemp-derived cannabinoids to be treated as food or supplements instead of drugs.

Swift criticism

Critics were swift to respond to the FDA’s announcement.

“Contrary to the FDA’s continued assertions regarding the safety of CBD, there is clear, established evidence of safety over the years,” said Jonathan Miller, general counsel at the U.S. Hemp Roundtable. “CBD products have been sold at retail for nearly a decade with no significant safety issues.”

Miller argued that existing dietary supplement and food pathways and regulations covering the manufacturing, labeling, and marketing of products are sufficient for CBD.

“We are going on five years with no regulation being blamed on concerns for health implications and we need those investments to support research that showcases the benefits and effectiveness of CBD use – and helps develop dosage guidelines based on those concerns,” Chase Terwilliger, CEO of Balanced Health Botanicals, told FOX Business.

Steve Mister of the Council for Responsible Nutrition, one of three petitioners which had asked FDA to allow the marketing of CBD products as dietary supplements,” told the Washington Post that the agency is “kicking the can down the road while ignoring the realities of the marketplace” by turning to Congress for a resolution.

“FDA has repeatedly disregarded evidence demonstrating safety that is relevant to CBD at the levels commonly used in supplements,” Mister said, claiming the agency’s concerns about CBD are based, wrongly, on indicators related only to high dosage CBD products, such as Epidiolex, a prescription drug that is the only cannabis-based product the FDA has approved.

Lawmaking

Congress has already been looking at CBD, having drafted legislation in 2021 that would have ensured that hemp-derived CBD and other non-intoxicating hemp ingredients could be marketed as dietary supplements. “The Hemp and Hemp-Derived CBD Consumer Protection and Market Stabilization Act of 2021,” which also would have required CBD products and hemp extract manufacturers to comply with existing safety rules for dietary supplements, appears to have died in a House committee early this month.

CBD could be dealt with in the 2023 Farm Bill which will be negotiated this year. Stakeholders have urged lawmakers to incorporate language into the Farm Bill that would designate CBD and other non-intoxicating cannabinoids as dietary supplements.

Curaleaf Holdings, Inc. (CSE: CURA) (OTCQX: CURLF) is finally exiting a trio of legacy western states in search for better profits. The stock was dropping over 5% in early trading on the news to lately sell at $3.61 not far from its 52-week low of $3.57.

The exodus will begin this month with the “proactive closure of the majority of its operations” including its production and cultivation facilities in California, Colorado, and Oregon, the company said on Thursday.

“Today’s announcement reflects a decision that we did not arrive at lightly, and one that makes sense for our business at this time,” CEO Matt Darin said in a statement.

10% of Employees Laid Off

“We have a fiduciary responsibility to our shareholders to improve margins and fortify our balance sheet by controlling what we can in our business. We believe these states will represent opportunities in the future, but the current price compression caused by a lack of meaningful enforcement of the illicit market prevent us from generating an acceptable return on our investments.”

At the same time, Curaleaf will also reduce its payroll by 10% “which, when coupled with other cost savings initiatives, it expects to realize $60 million in gross run-rate expense savings in 2023, exceeding its initial savings target by 50%.”

The MSO giant will also consolidate its Massachusetts cultivation and processing operations, with plans to record the actions as non-cash restructuring and impairment charges that it said it will detail on its March fourth quarter earnings call. The company said it will focus on generating cash flow in its core revenue-driving markets.

The news comes in a timely fashion, as Curaleaf has seen slowing growth amid a broader slowdown in the global economy and lulled efforts concerning U.S. federal legalization.

The company laid off around 220 of its employees ahead of the Thanksgiving holiday last year after its most recent earnings showed crimping margins and rising losses despite surviving revenue expectations.

In a Nov. 7 earnings call, founder and chairman Boris Jordan told investors that management is “acutely aware of the economic conditions our customers are navigating.”

“As such, we are taking appropriate actions to ensure we continue driving growth and margin expansion next year, irrespective of the economic climate,” Jordan said at the time.

Darin said during the call that the company is “comfortably transitioning from the asset accumulation phase to the asset optimization phase in our evolution. Importantly, we are at this juncture by choice, not market force.”

Illicit Market Cited

“These adjustments were necessary for the future success and profitability of the business and were made as a result of recent legislative decisions, price compression, and lack of enforcement of the illicit market,” the company wrote in the Thursday memo. “For context, these markets contributed less than $50 million in revenue to Curaleaf last year.”

Curaleaf expects the exits to be accretive to its adjusted EBITDA margins and positions the balance sheet for positive free cash flow generation “in excess of $125 million” in 2023.

“We are confident that these moves, made to improve our cashflow and margins, are the right ones to bolster the future success and profitability of Curaleaf,” Darin said on Thursday. “Optimizing the existing portfolio in this way allows us to enter 2023 in a position of strength and further enhances our visibility around continued margin expansion and highly profitable growth. We remain excited about our future growth prospects both domestically and internationally, and now can devote greater resources to tangible growth opportunities in emerging markets such as Europe.”

New York state regulators on Wednesday awarded another 30 licenses to operate recreational marijuana stores, though a pending lawsuit is still blocking adult-use retail in key locations across the state.

The Office of Cannabis Management has now licensed 66 retailers in the state, though as of Tuesday, only two have opened for business.

Both are located in lower Manhattan.

A third, in Manhattan’s Union Square, is scheduled to open Feb. 13, according to New York TV station WNBC.

Of the 30 licenses awarded Wednesday, 16 were issued in New York City – eight in Manhattan and four each in the Bronx and Queens.

There are still no licensed dispensaries in Brooklyn and four other areas upstate, all of which have been stalled because of a lawsuit filed by an out-of-state company alleging the state’s licensing scheme violates federal law by favoring New Yorkers.

All adult-use retail licenses in New York state are currently awarded to:

- Qualifying individuals with a previous cannabis conviction or a family member with a conviction and a history of running a successful business.

- A nonprofit with a history of serving people involved with the criminal justice system and with at least one “justice involved” board member.

Twenty-eight of the licenses awarded Wednesday went to qualified individuals. Those licensees are permitted to seek out their own real estate or operate in a “turnkey” location set up by the state Dormitory Authority.

The state’s existing 10 medical marijuana companies, including major multistate operators Columbia Care and Curaleaf Holdings, are still waiting to enter New York’s adult-use industry.

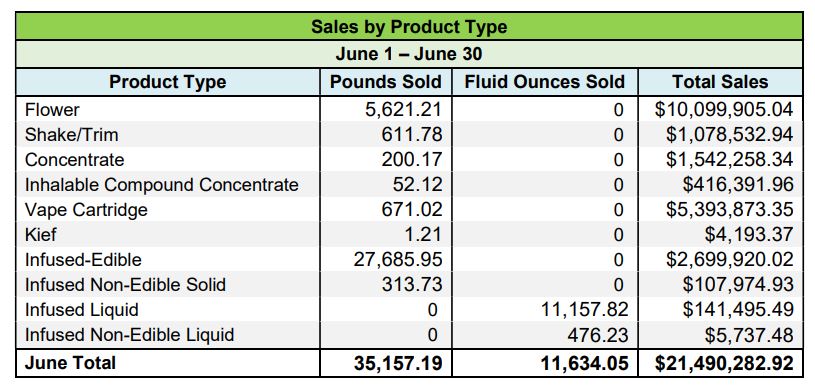

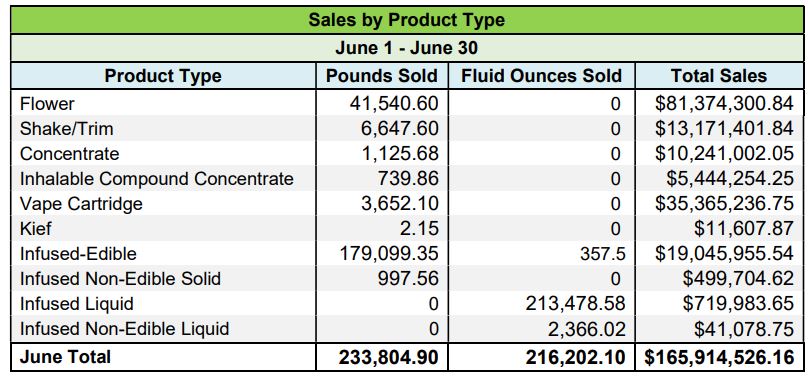

Michigan marijuana sales reached a record high in December, state data shows.

While medical cannabis purchases have gradually declined, the adult-use market has more than made up for that drop, with total sales hitting $221.7 million last month. That’s about $9 million more than the previous record set in September.

The state Cannabis Regulatory Agency (CRA) shows that December saw $208,318,037 in recreational cannabis sales and $13,419,377 from medical marijuana purchases, as New Cannabis Ventures first reported.

What’s more, the state is experiencing this total sales surge even as the average cost of marijuana has continued to dip, with the price of an ounce now hovering around $90. In December 2021, by contrast, the cost of an ounce was about $180.

Most of the cannabis purchases came from flower, followed by vape cartridges and infused edibles, CRA’s data reveals.

Arizona’s marijuana market has seen similar trends, with the state recently announcing that cannabis sales reached a record high in October. Medical marijuana purchases are also declining in the state, but the recreational market is on an upward trajectory.

Illinois marijuana sales hit a record high of more than $1.5 billion in 2022—and this past December marked the strongest sales month to date—officials announced earlier this month.